A view of downtown Denver from above the Capitol building. (Courtesy of Guerilla Capturing)

Last updated Oct. 9, 2024 – see log of changes at bottom of story

The pandemic brought major changes to how companies use office space — and that has put many landlords in a difficult position.

Interest rates have made refinancing loans difficult. Downsizing and sublease trends have impacted building valuations. All the while, if they haven’t matured already, loans secured by office towers are still inching closer to that date.

BusinessDen scoured county foreclosure records, third-party reports and court filings to determine the downtown and suburban buildings that have exhibited signs of distress — which can take a number of different forms — since the pandemic began.

The below list is not necessarily comprehensive, but will be updated when we have more information, or when a particular property’s situation changes.

Foreclosed/deed-in-lieu of foreclosure in Denver area

Denver Energy Center

Address: 1625 and 1675 Broadway, Denver

Year Built: 1979

Denver Energy Center in 2022 (BusinessDen file)

Square Footage: 785,000

Owner: Gemini Rosemont

Situation: Bought by lender at foreclosure auction

Los Angeles-based Gemini Rosemont bought the complex for $176 million in 2013 with the help of a $114 million loan from JPMorgan Chase. Gemini missed months of payments, leading Chase to initiate the foreclosure process in late 2021.

A foreclosure auction was held in June 2022. Chase won because it was the only bidder, offering a credit bid of $88.2 million.

Triad Office Complex

Address: 5660-5680 Greenwood Plaza Blvd., Greenwood Village

Year Built: 1972

The office building at 5660 Greenwood Plaza Blvd. (BusinessDen file)

Square Footage: 414,000

Owner: Focus Property Group

Lender: Voya Financial affiliate

Situation: Bought by lender at foreclosure auction

Focus paid $54 million in February 2020 for the Triad complex, which consists of three identical buildings. It financed the deal with a $53.7 million loan from Voya.

In April 2023, Voya sued, saying the owner had defaulted on the loan in multiple ways. A receiver was appointed. Foreclosure proceedings were initiated in July 2023. In early December, Voya purchased the property at auction with a $46.4 million credit big.

7100 E. Belleview

Address: 7100 E. Belleview Ave., Greenwood Village

Year Built: 1981

7100 E. Belleview Ave. in 2023 (BusinessDen file)

Square Footage: 179,000

Owner: Westport Capital Partners

Lender: Voya Financial affiliate

Situation: Deed in lieu of foreclosure

Westport paid $19.9 million for the property in December 2015, according to public records. It took out a $21.08 million loan from an affiliate of Voya Financial in December 2019.

Voya sued in July 2023, saying the owner had defaulted on the loan by terminating the building’s management agreement without Voya’s consent. A receiver was appointed. In late August 2023, the lender said in court filings that Westport had agreed to give the lender ownership rather than going through foreclosure. Ownership transferred in September 2023.

The 410

Address: 410 17th St., Denver

Year Built: 1977

The 410 in 2019 (BusinessDen file)

Square Footage: 435,000

Owner: RREF III-P 410 17th St LLC, a joint venture between Rialto Capital Management and Steelwave

Lender: Ares Commercial Real Estate affiliate

Situation: Deed in lieu of foreclosure after loan sale

The owner paid $127.25 million for the 24-story tower in June 2019 and took out a $113.05 million loan at the same time, records show. The maturity date on the loan was Jan. 5, 2023, with a possible extension to 2025.

The building’s lender initiated foreclosure proceedings in July 2023, saying the owner had defaulted on the loan due to “the failure to make timely payments of principal and interest when due.” The lender said it’s still owed $96.18 million on the original loan.

As of August, the building was 37 percent leased, according to CoStar, with 12 percent of that described as “available,” meaning the current tenant is expected to move out. The building lost a major tenant earlier this year when the law firm Brownstein Hyatt Farber Schreck, which leased 130,000 square feet, moved to 675 15th St.

In February 2024, Cress Capital purchased the building’s loan. On April 30, Cress took ownership of the tower via a deed in lieu of foreclosure.

1630 Welton St.

1630 Welton St. (BusinessDen file)

Address: 1630 Welton St., Denver

Square footage: 115,000

Owner: Expansive, a Chicago-based coworking firm

Lender: RRA Capital

Situation: Deed in lieu of foreclosure

Expansive bought the downtown building in 2017. In September 2022, it refinanced with a $12.3 million loan from RRA Capital. In early July 2023, Expansive executed a deed-in-lieu-of-foreclosure, giving the building to the lender.

Cascades

Address: 6300 S. Syracuse Way, Centennial

6300 S. Syracuse Way. (Google Maps)

Year built: 1984

Square footage: 350,000

Owner: Florida-based America’s Capital Partners

Situation: Bought by lender at foreclosure auction

The owner paid $63 million in February 2017 and took out two loans totaling $44 million from an affiliate of Voya Financial. The lender executed a call option and the owner failed to pay off the loans by March 1, 2024. Voya requested a receiver be appointed on March 5.

In mid-April, Voya filed to foreclose on the property. In September, Voya purchased the property at auction with a credit bid of $29.35 million.

Sold after default

Industry Denver

Address: 3001 Brighton Blvd., Denver

Year Built: Adaptive reuse and new construction in mid-2010s

Square Footage: 150,000

Owner: Clarion Partners and Q Factor, operating as 3001 Brighton LLC

Lender: Affiliates of AIG

Situation: In receivership, sale pending

The owner defaulted on two loans issued in 2016 by failing to pay them off by their maturity date of Nov. 1, 2023. A receiver was appointed at the lender’s request on Dec. 6, 2023. Ownership still owed $28.7 million on the loans as of that date.

In late August, the property sold for $19 million to Boulder-based Conscience Bay Co.

In Foreclosure in Denver area

1801 Broadway

1801 Broadway (BusinessDen file)

Address: 1801 Broadway, Denver

Year Built: 1981

Square Footage: 198,000

Owner: Expansive, a Chicago-based coworking firm

Lender: Loancore Capital

Situation: In foreclosure, receivership

The owner, at the time known as Novel Coworking, paid $40.2 million for the 17-story office building in April 2019, financing the deal with a $35.4 million loan.

In an August 2023 lawsuit, the lender said the loan matured in April 2023 and had not been paid off. It said Expansive owed $34.6 million and that it intended to foreclose. A receiver was appointed.

In January 2024, the lender filed for foreclosure. Expansive’s chief financial officer told BusinessDen the company expects to give the building back to the lender.

700 17th St.

Address: 700 17th St., Denver

700 17th St. (BusinessDen file)

Square footage: 182,500 square feet

Year built: 1960

Owner: Denver-based Toma West

Status: In foreclosure

Toma West’s 700 17th Street LLC paid $32 million for the property in June 2016, although Toma West had also been affiliated with the previous LLC that bought it in 2006. The $21 million, 10-year loan that financed the 2016 deal came from New York-based Benefit Street Partners.

Toma West defaulted on the loan by early 2024 by falling behind on payments. The loan was transferred to special servicing in March 2024. The lender successfully requested a receiver in July 2024, and initiated the foreclosure process in August 2024.

Solarium

Address: 7400 E. Orchard Road, Greenwood Village

Solarium (Google Maps)

Year built: 1982

Square footage: 170,000

Owner: Austin-based CapRidge Partners

Situation: In foreclosure, receivership

The owner paid $23.4 million in November 2014. In December 2020, the owner took out a $20.39 million loan from KeyBank that was later assigned to New York-based Ready Capital. The lender said in a January 2024 court filing that the owner defaulted on the loan in multiple ways, including by paying to pay it off upon maturity in December 2023. A receiver was appointed.

On March 1, 2024, the lender filed to foreclose on the property. In late August, the lender sold the loan to LBC3 Trust.

Harlequin Plaza

Address: 7600 E. Orchard Road, Greenwood Village

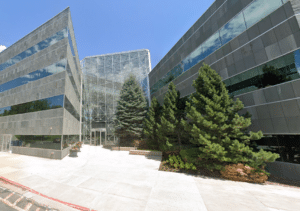

Harlequin Plaza, at 7600 E. Orchard Plaza in Greenwood Village, consists of two nearly identical buildings. (Google Maps)

Year built: 1980

Square footage: 330,000 square feet

Owner: Unico Properties

Situation: Receiver requested

The owner bought the two-building complex in October 2012 for $26.55 million. In May 2014, Unico took out a $28 million loan from Wells Fargo Bank. In July 2024, a trustee for the loan sued, requesting a receiver and saying Unico had defaulted on the loan by failing to pay it off upon maturity the previous month.

The property entered foreclosure in October.

Defaulted, not in foreclosure, in Denver Area

1670 Broadway

Address: 1670 Broadway

1670 Broadway (BusinessDen file)

Year Built: 1980

Square Footage:

Owner: HFI 1670 Bdwy LLC

Situation: In special servicing

The owner paid $238 million for the tower in 2018, records show, financing the deal with a $78 million loan from the seller. In September 2023, the owner defaulted on that loan when it failed to pay it off upon maturity. The loan was transferred to special servicing shortly before the default, in August 2023.

Wells Fargo Center

Address: 1700 Lincoln St., Denver

Wells Fargo Center (BusinessDen file)

Year Built: 1983

Square Footage: 1.2 million square feet

Owner: New York-based Brookfield Properties

Lender: Affiliate of Morgan Stanley

Situation: In receivership

The owner defaulted on the building’s loan when they failed to pay it off upon maturity in December 2022. The loan was then sent to special servicing.

In August 2023, a receiver was appointed to oversee the property at the lender’s request. The move followed a string of negative leasing news for the building; Wells Fargo and WeWork each said they are or intend to drop three of their floors.

Writer Square

Address: 1512 Larimer St., Denver

Year Built: 1980

Square Footage: 186,000

Owner: Kroenke Sports & Entertainment

Lender: Goldman Sachs

Situation: In special servicing

The owner paid $96 million for the property in late 2016.

Trepp, a firm that tracks commercial real estate loans, said in August 2023 comments that the property’s $59 million loan “transferred due to non-compliance with cash management. A PNL was executed in October 2022 and discussions with Borrower are ongoing on a resolution. Special Servicer is currently assessing its next steps and monitoring property performance.”

Columbine Place

Address: 216 16th St., Denver

Columbine Place (BusinessDen file)

Year Built: 1981

Square Footage: 150,000

Owner: Columbine West LLC

Lender: SG Americas Securities

Situation: In special servicing

According to Trepp, the building’s $15.5 million loan will mature in October 2025. The loan transferred to special servicing in October 2022, according to Trepp, which said in a note in August 2023 that the owner and lender are “finalizing terms for a friendly foreclosure” or deed in lieu of foreclosure. The building’s occupancy has fallen from 96 percent in 2015 to 47 percent in July 2022.

In November, a receiver was appointed to oversee the building at the request of an affiliate of Rialto Capital, which has been assigned the loan.

Meridian One

Address: 9785 Maroon Circle, Douglas County

Meridian One (Google Maps)

Year built: 1984

Square footage: 140,000 square feet

Owner: Portland, Oregon-based Felton Properties

Situation: In receivership

The owner paid $12.8 million in 2014. In December 2019, Societe Generale issued a $16.4 million loan secured by the property. The owner defaulted on the loan in multiple ways by August 2023, including failing to make the July principal and interest payment, according to a lawsuit filed by the lender’s trustee. A receiver was appointed.

Gateway Plaza at Meridian

Address: 9800 S. Meridian Blvd., Douglas County

Gateway Plaza at Meridian (Google Maps)

Year built: Mid-1990s

Square footage: 142,000

Owner: Portland, Oregon-based Felton Properties

Situation: In receivership

Felton bought the property for $21.55 million in December 2016, records show. The company financed the Gateway acquisition with a $17.05 million loan from Barclays Bank. The owner defaulted on the building’s $17 million loan by failing to make the required payments starting in July 2023, according to a lawsuit filed by the lender’s trustee. A receiver was appointed.

1495 Canyon Blvd.

Address: 1495 Canyon Blvd., Boulder

1495 Canyon Blvd. (Google Maps)

Square footage: 22,500

Owner: Expansive, a Chicago-based coworking firm

Situation: Defaulted

The owner purchased the building in January 2018, paying $6.5 million. In October 2019, Expansive took out a $7.5 million loan from Greenwood Village-based Bellco Credit Union secured by the property. In a lawsuit filed in January 2024, Bellco said that Expansive defaulted on that loan in multiple ways.

Zeppelin Station

Address: 3501 Wazee St., Denver

Zeppelin Station (BusinessDen file)

Square footage: 102,000

Owner: Zeppelin Development

Lender: Wells Fargo

Situation: In receivership

The owner completed construction of the building in 2018 and took out a $32 million loan from Wells Fargo Bank in 2019. In March 2024, Wells Fargo filed a lawsuit requesting a receiver for the property. Wells Fargo said the loan had been in default since June 2021.

On May 13, following a hearing, a judge appointed a receiver for the property.

Denver West Business Park

Address: 82 acres bisected by Interstate 70 in Lakewood; numerous addresses

A sign for the Denver West Business Park (Courtesy DPC Cos. via The Denver Post)

Square footage:

Owner: DPC Cos. and Bridge Investment Group

Status: In receivership

DPC and Bridge paid $144 million for the property in November 2018. The firms financed the deal with a $120 million loan from Cleveland-based KeyBank.

KeyBank sued the ownership group in June 2024, saying the loan matured in mid-November 2023 and hadn’t been paid off. A receiver was appointed.

Default expected

Offices at Broadway Station

Address: 900 and 990 S. Broadway, 100 E. Tennessee Ave., Denver

900 S. Broadway (BusinessDen file)

Year built: 1903/1984/2008

Square footage: 318,000

Owner: Sagard Real Estate

Situation: Loan in special servicing ahead of expected default

Sagard bought the complex in July 2014 for $73.25 million and financed the deal with a $47.6 million loan from Wells Fargo Bank. In April 2024, the loan was transferred to special servicing due to an expected default when the loan matures in August 2024.

No longer in default

Republic Plaza

Address: 370 17th St., Denver

Year Built: 1984

Republic Plaza in 2021 (BusinessDen file)

Square Footage: 1.3 million square feet

Owner: New York-based Brookfield Properties and Metlife Investment Management

Situation: Emerged from special servicing

The 56-story tower is Denver’s tallest building. The owner defaulted on its $243 million loan in December 2022 when it failed to pay it off upon maturity. The loan was sent to special servicing.

In July 2023, the owner said it had reached a loan modification deal with the lender that included extending the terms of the loan through March 2026. The move followed a couple wins on the leasing front, most notably a 74,000-square-foot lease deal struck with the city for the Denver District Attorney’s Office.

When was this story last updated?

Oct. 9: Updated entry about Solarium to note loan sale, update entry about Harlequin Plaza to note foreclosure filing

Sept. 16: Updated entry about Cascades to note outcome of foreclosure auction. Updated entry about Industry to note sale

Aug. 18: Moved 700 17th St. to “In foreclosure” category

July 23: Updated entry about Industry Denver to note pending sale

July 16: Added entries about 1630 Welton St., 700 17th St., Offices at Broadway Station, Denver West Business Park and Harlequin Plaza

May 28: Updated multiple entries

April 23: Updated entry about Zeppelin Station to note receiver appointed

April 17: Updated entry for The 410 to note sale of loan

March 27: Added entry about Zeppelin Station

March 7: Updated Solarium entry to note foreclosure filing; Added entry about 1495 Canyon Blvd.

March 6: Added entry about Cascades

Jan. 24: Added entry about Gateway Plaza at Meridian

Jan 16: Added entry about Solarium building

Jan. 5: Updated 1801 Broadway entry to note foreclosure filing

Dec. 13: Added entry about Meridian One building; reorganized entries

Dec. 11: Updated Triad Office Complex entry to note foreclosure sale

Dec. 6: Added entry about Industry Denver at 3001 Brighton Blvd.

Nov. 26: Added entry about 1670 Broadway

Nov. 8: Added reference to appointment of receiver for Columbine Place