A view of downtown Denver from above the Capitol building. (Courtesy of Guerilla Capturing)

On June 27, 2019, three downtown Denver office towers sold for a combined $330 million.

They would be just one of the many office transactions that year, with $2.7 billion in office sales recorded in 2019, according to CBRE data, which covers the metro area. That figure hovered around $2.5 billion in 2021 and 2022.

But last year, that office sales slumped to $894 million, a 67% percent drop from four years ago. The big sale of the year was Riverview, an office building at the edge of downtown that fetched $129 million in December. As the first quarter of 2024 comes to a close, no transaction has snagged a sales price north of nine figures.

And that’s just one way of quantifying Denver’s real estate freeze.

“I wouldn’t necessarily call it a mindset shift,” said Charley Will, a broker and leader of the institutional properties group with CBRE. “Maybe a better way to explain it would be over the last 18 to 24 months, there hasn’t been much clarity or certainty in how interest rates are going to behave going forward. There’s been a lot of volatility.”

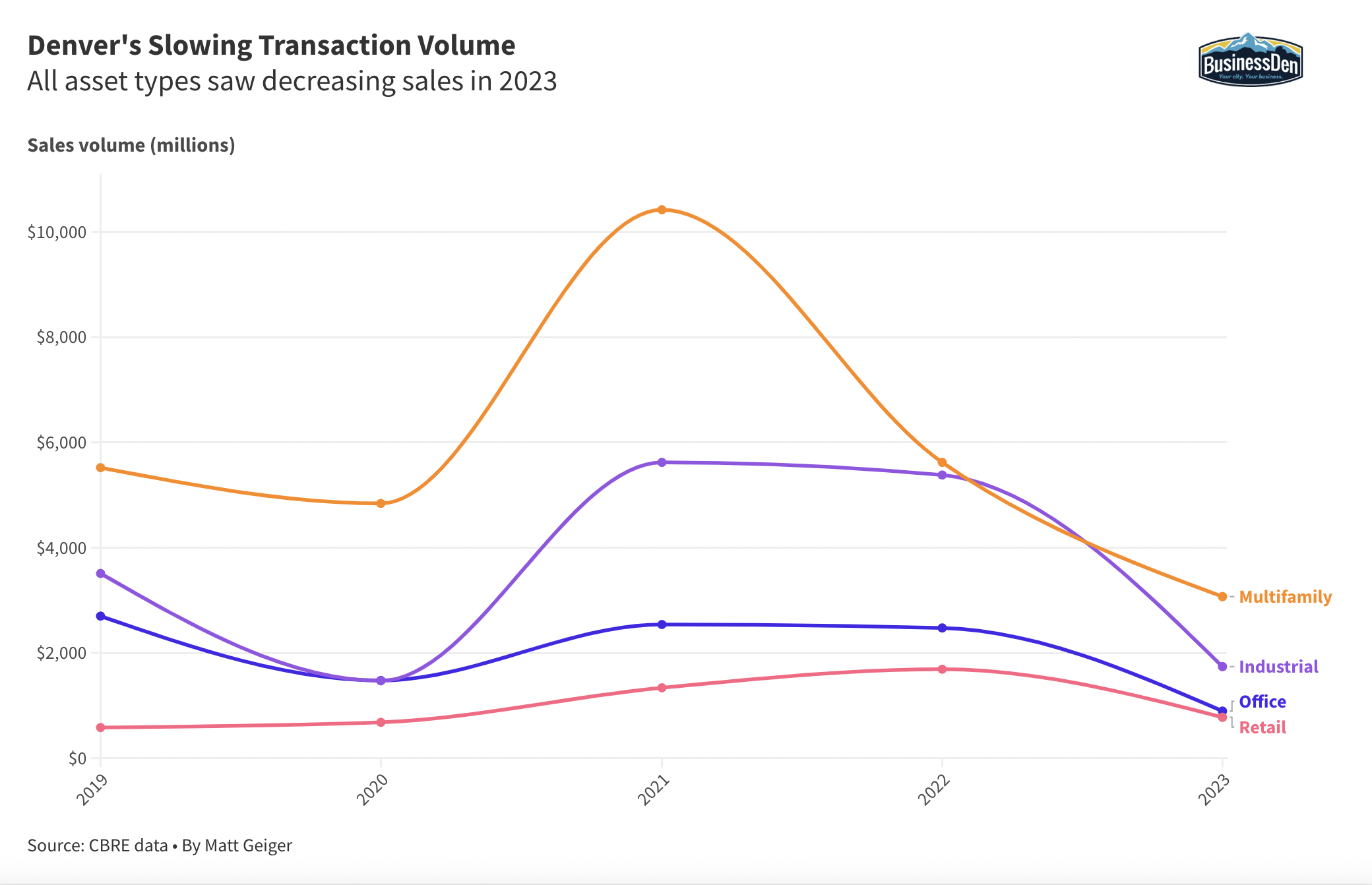

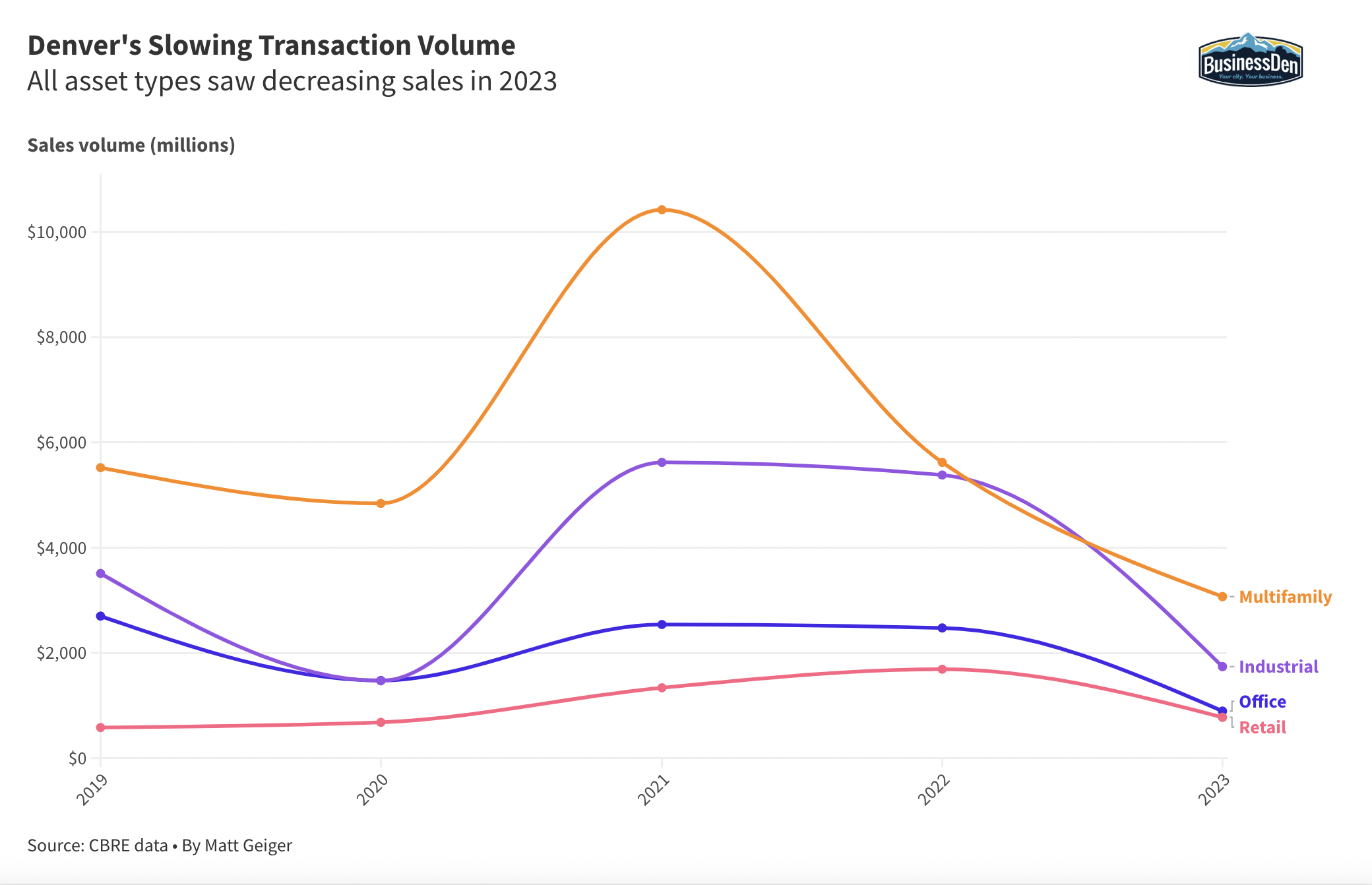

The weariness on interest rates has impacted other real estate types as well. Industrial, retail and multifamily assets have also been selling less than in previous years, according to the CBRE data.

Industrial, for example, notched a sales volume of $1.74 billion last year. In 2022, that figure was $5.38 billion. The same story can be said of retail and multifamily, which had a sales total of $1.69 billion and $5.62 billion in 2022, much higher than 2023’s $777 million for retail and $3.07 billion for multifamily.

A graph of real estate sales by asset type from 2019 to 2023. (Graph by BusinessDen based on CBRE data)

But offices in particular have struggled. Nearly 17 percent of all Denver office space lays vacant, one of the highest rates in the country, according to CoStar data. Only San Francisco and nearby East Bay in California have seen larger drops in occupancy since 2019.

It’s not just interest rates that are of concern to investors and those looking to trade office real estate. The underlying fundamentals — the rise of remote and hybrid work — are cause for question marks, not dollar signs.

Charley Will

Will, however, said he believes “perception is lagging reality downtown.”

“The reality on the ground here in Denver is it feels a lot more vibrant,” Will said. “There’s more people downtown. It’s cleaner than it was even a year ago. And when we have investors in town they don’t think of our downtown as a shell of what it used to be anymore. It’s coming back to life.”

CoStar data suggests a bottoming out of office sales to take place sometime in 2025, when sales volume will sink to $600 million. That number rebounds slightly to $800 million in 2027, which is as far out as CoStar’s data predicts.

But brokers remain confident that the underlying real estate remains valuable.

“It’s like the Mark Twain quote: ‘The reports of my death are greatly exaggerated’,” said Joey Gargotto, broker with NAI Shames Makovsky.

While Will deals with big institutional clients, Gargotto’s sweet spot is in brokering office spaces worth $1 million to $10 million. Many of his clients are users — people looking to find a place to house their own business. That group has remained “durable,” he said.

“Has something fundamental about my business changed? I don’t think it has,” Gargotto said.

Joey Gargotto

The broker added that professional services in particular — the law firm, insurance agent and engineering company — are examples of users who continue to need office space. The same maxims about what makes a great real estate investment, quality and location, remain just as important as they were before the pandemic, he said.

“If you’re buying an office building that has excellent visibility, easy access, impressive zoning in terms of the sorts of things you can do down the road, great parking, close to population centers … there’s just more places that that purchase can go,” Gargotto said.

What has changed is that fewer investors are making moves in the market.

“Investors have been expecting that prices need to correct, and that’s where I think a lot of dollars have been left on the sideline,” the broker added.

Gargotto’s data provides more context. Tracking transactions between $250,000 and $50 million in the city itself, the numbers he provided to BusinessDen show a 38.7% decrease in office sales volume from 2022 to 2023. In that same span, over that same category, the price per square foot was up by 0.5% percent.

“The market is moving, just slower than we want,” he said.

For brokers in the leasing market, though, the slow sales market for others has been a boon for them and their clients.

“The deals that can be struck right now are literally unbelievable deals. But that’s the perspective of the occupier — the user,” said Jim Tyler, broker at Kentwood Commercial.

The average office rent in Denver sits at $29 a square foot, which is about the same asking rate at the start of 2020, according to CoStar data. This number is expected to decline, bottoming out around the middle of next year.

“The office building is not going away in my lifetime. It’s not going away in your lifetime. It’s still going to be a viable way to conduct business,” Tyler said.

Jim Tyler

What is changing, though, is the difference in rents between spaces of varying quality.

“What’s exciting now is the delta differential between C, B and A and AA buildings. The delta is so far spread wide open now, you can get a deal done in the teens for a C building. And they were all bunched up three or four years ago, the rental rates were bunched up. There wasn’t a big change between C, which was at $20, B was at $30, A was at $40 and AA was at $50 base rent,” Tyler said.

The widening spread is accompanied by an increasing demand for a smaller group of locations, with smaller spaces too. Tyler said that few large tenants are active, with much of the movement coming from businesses seeking to shrink their floor plans and move to more-desirable neighborhoods.

Cherry Creek is arguably the hottest office market in the city. CoStar data suggested that some rents have pushed north of $45 a square foot, with some newly built offices quoting businesses for $75 per square foot.

It’s fitting that Cherry Creek is also where CBRE’s Will sees the larger investment office players returning to the market.

“My prediction, which is based on feedback from investors, is that it’ll start (the office market comeback) in the most desirable neighborhoods,” he said. “So for Denver, that would be lower downtown and neighborhoods adjacent to lower downtown. It would be Cherry Creek North, it would be parts of the Denver Tech Center, Boulder, parts of Northwest Denver like Interlocken.”

A view of downtown Denver from above the Capitol building. (Courtesy of Guerilla Capturing)

On June 27, 2019, three downtown Denver office towers sold for a combined $330 million.

They would be just one of the many office transactions that year, with $2.7 billion in office sales recorded in 2019, according to CBRE data, which covers the metro area. That figure hovered around $2.5 billion in 2021 and 2022.

But last year, that office sales slumped to $894 million, a 67% percent drop from four years ago. The big sale of the year was Riverview, an office building at the edge of downtown that fetched $129 million in December. As the first quarter of 2024 comes to a close, no transaction has snagged a sales price north of nine figures.

And that’s just one way of quantifying Denver’s real estate freeze.

“I wouldn’t necessarily call it a mindset shift,” said Charley Will, a broker and leader of the institutional properties group with CBRE. “Maybe a better way to explain it would be over the last 18 to 24 months, there hasn’t been much clarity or certainty in how interest rates are going to behave going forward. There’s been a lot of volatility.”

The weariness on interest rates has impacted other real estate types as well. Industrial, retail and multifamily assets have also been selling less than in previous years, according to the CBRE data.

Industrial, for example, notched a sales volume of $1.74 billion last year. In 2022, that figure was $5.38 billion. The same story can be said of retail and multifamily, which had a sales total of $1.69 billion and $5.62 billion in 2022, much higher than 2023’s $777 million for retail and $3.07 billion for multifamily.

A graph of real estate sales by asset type from 2019 to 2023. (Graph by BusinessDen based on CBRE data)

But offices in particular have struggled. Nearly 17 percent of all Denver office space lays vacant, one of the highest rates in the country, according to CoStar data. Only San Francisco and nearby East Bay in California have seen larger drops in occupancy since 2019.

It’s not just interest rates that are of concern to investors and those looking to trade office real estate. The underlying fundamentals — the rise of remote and hybrid work — are cause for question marks, not dollar signs.

Charley Will

Will, however, said he believes “perception is lagging reality downtown.”

“The reality on the ground here in Denver is it feels a lot more vibrant,” Will said. “There’s more people downtown. It’s cleaner than it was even a year ago. And when we have investors in town they don’t think of our downtown as a shell of what it used to be anymore. It’s coming back to life.”

CoStar data suggests a bottoming out of office sales to take place sometime in 2025, when sales volume will sink to $600 million. That number rebounds slightly to $800 million in 2027, which is as far out as CoStar’s data predicts.

But brokers remain confident that the underlying real estate remains valuable.

“It’s like the Mark Twain quote: ‘The reports of my death are greatly exaggerated’,” said Joey Gargotto, broker with NAI Shames Makovsky.

While Will deals with big institutional clients, Gargotto’s sweet spot is in brokering office spaces worth $1 million to $10 million. Many of his clients are users — people looking to find a place to house their own business. That group has remained “durable,” he said.

“Has something fundamental about my business changed? I don’t think it has,” Gargotto said.

Joey Gargotto

The broker added that professional services in particular — the law firm, insurance agent and engineering company — are examples of users who continue to need office space. The same maxims about what makes a great real estate investment, quality and location, remain just as important as they were before the pandemic, he said.

“If you’re buying an office building that has excellent visibility, easy access, impressive zoning in terms of the sorts of things you can do down the road, great parking, close to population centers … there’s just more places that that purchase can go,” Gargotto said.

What has changed is that fewer investors are making moves in the market.

“Investors have been expecting that prices need to correct, and that’s where I think a lot of dollars have been left on the sideline,” the broker added.

Gargotto’s data provides more context. Tracking transactions between $250,000 and $50 million in the city itself, the numbers he provided to BusinessDen show a 38.7% decrease in office sales volume from 2022 to 2023. In that same span, over that same category, the price per square foot was up by 0.5% percent.

“The market is moving, just slower than we want,” he said.

For brokers in the leasing market, though, the slow sales market for others has been a boon for them and their clients.

“The deals that can be struck right now are literally unbelievable deals. But that’s the perspective of the occupier — the user,” said Jim Tyler, broker at Kentwood Commercial.

The average office rent in Denver sits at $29 a square foot, which is about the same asking rate at the start of 2020, according to CoStar data. This number is expected to decline, bottoming out around the middle of next year.

“The office building is not going away in my lifetime. It’s not going away in your lifetime. It’s still going to be a viable way to conduct business,” Tyler said.

Jim Tyler

What is changing, though, is the difference in rents between spaces of varying quality.

“What’s exciting now is the delta differential between C, B and A and AA buildings. The delta is so far spread wide open now, you can get a deal done in the teens for a C building. And they were all bunched up three or four years ago, the rental rates were bunched up. There wasn’t a big change between C, which was at $20, B was at $30, A was at $40 and AA was at $50 base rent,” Tyler said.

The widening spread is accompanied by an increasing demand for a smaller group of locations, with smaller spaces too. Tyler said that few large tenants are active, with much of the movement coming from businesses seeking to shrink their floor plans and move to more-desirable neighborhoods.

Cherry Creek is arguably the hottest office market in the city. CoStar data suggested that some rents have pushed north of $45 a square foot, with some newly built offices quoting businesses for $75 per square foot.

It’s fitting that Cherry Creek is also where CBRE’s Will sees the larger investment office players returning to the market.

“My prediction, which is based on feedback from investors, is that it’ll start (the office market comeback) in the most desirable neighborhoods,” he said. “So for Denver, that would be lower downtown and neighborhoods adjacent to lower downtown. It would be Cherry Creek North, it would be parts of the Denver Tech Center, Boulder, parts of Northwest Denver like Interlocken.”