The only branch of Solera National Bank is at 319 S. Sheridan Blvd. in Lakewood. (Justin Wingerter/BusinessDen)

A local shareholder will examine the internal records of a single-branch bank in Lakewood to determine whether its chairman squandered the bank’s profits on a fleet of aircraft that he used to travel to Denver Nuggets games, where he became known as the “Red Pant Man.”

In an oral ruling Feb. 6 that took more than an hour to read, Delaware Chancery Court Judge Bonnie David decided that Rob Salazar can inspect certain records of Solera Bank.

“I am convinced that the (bank) board’s decision not to pay a dividend in 2020, viewed together with the company’s acquisition of an aircraft at the end of 2020, does support an inference of possible wrongdoing,” David said, according to a transcript of her remarks.

Michael Quagliano, an Illinois native who lives in Florida, is the majority shareholder and chairman of the publicly traded Solera National Bank, which opened in 2006 with a focus on Hispanic customers. Its only location is at 319 S. Sheridan Blvd. in Lakewood.

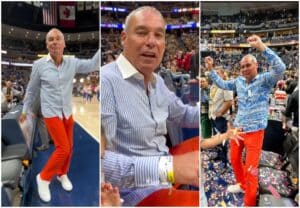

He is also @TheRealRedPantMan on TikTok and a courtside staple at Nuggets games, where he dances around, teases opponents and takes selfies in signature trousers.

Salazar, whose family office Central Street Capital has real estate projects in Glendale and Globeville’s Fox Island, sued Solera’s holding company on Sept. 22, seeking access to Solera’s internal reports and finances so that he can investigate its plane purchases and Quagliano’s flights. Salazar has a background in accounting and owns Solera stock.

“A single-branch community bank has no apparent need for any aircraft, let alone a veritable airline,” he alleged in the lawsuit. “That decision, standing alone, sounds in waste.”

Reached by BusinessDen soon after the lawsuit was filed, Quagliano denied using Solera’s jets to travel to Nuggets games and said the bank’s aircraft are leased to flight schools, resulting in a tax deduction and “very, very good return” for Solera. He called Salazar a liar.

“Whatever he’s entitled to, we’re going to give him,” Quagliano said. “I’ve got nothing to hide.”

Judge David’s ruling this month ends the case but also shines new light on what happened behind closed doors at Solera after its December 2020 announcement that it would be paying its first dividends and then its decision five months later to buy a $4.8 million jet instead.

David found that “an unnamed whistleblower” within Solera alerted the company’s audit committee about the “rushed” jet purchase, which was made against the advice of its CEO and without its board of directors’ approval. The board reacted by removing Quagliano as chairman and hiring a forensic accounting firm to review the airplane purchase.

That firm’s final report “noted numerous instances in which it appears that Quagliano used the aircraft for personal use without properly reimbursing the bank for the cost of said use,” according to David’s ruling. The report was shown to Quagliano in mid-2021.

“What a waste of (Solera) shareholders’ money,” the chairman responded. “This is a joke. Our own aviation tax consultant sanctioned and monitored the jet action.”

“I am so scared,” he said sarcastically, “I am not bothering to forward this to my attorney.”

One week later, Quagliano’s allies on the board of directors reappointed him executive chairman and set his annual salary at $500,000, according to David’s order. Solera has since purchased at least four more airplanes and a helicopter, according to the judge.

Salazar’s lawsuit did not seek damages from Solera, only a large trove of documents. David determined that he has a right to some, but not all, of what he wanted.

Solera must turn over flight logs for any company aircraft used by Quagliano or other bank executives, along with some documents related to purchase of the aircraft and the decision not to pay a dividend. But Salazar doesn’t have a right to investigate the bank’s capital levels, liquidity levels, or expenses for airplane maintenance and insurance, David said.

Solera Bank and its attorneys did not respond to requests for comment about the decision.

“I am very pleased with the outcome of this lawsuit,” Salazar told BusinessDen.

“Once we receive and review all information, we will determine next steps.”

The only branch of Solera National Bank is at 319 S. Sheridan Blvd. in Lakewood. (Justin Wingerter/BusinessDen)

A local shareholder will examine the internal records of a single-branch bank in Lakewood to determine whether its chairman squandered the bank’s profits on a fleet of aircraft that he used to travel to Denver Nuggets games, where he became known as the “Red Pant Man.”

In an oral ruling Feb. 6 that took more than an hour to read, Delaware Chancery Court Judge Bonnie David decided that Rob Salazar can inspect certain records of Solera Bank.

“I am convinced that the (bank) board’s decision not to pay a dividend in 2020, viewed together with the company’s acquisition of an aircraft at the end of 2020, does support an inference of possible wrongdoing,” David said, according to a transcript of her remarks.

Michael Quagliano, an Illinois native who lives in Florida, is the majority shareholder and chairman of the publicly traded Solera National Bank, which opened in 2006 with a focus on Hispanic customers. Its only location is at 319 S. Sheridan Blvd. in Lakewood.

He is also @TheRealRedPantMan on TikTok and a courtside staple at Nuggets games, where he dances around, teases opponents and takes selfies in signature trousers.

Salazar, whose family office Central Street Capital has real estate projects in Glendale and Globeville’s Fox Island, sued Solera’s holding company on Sept. 22, seeking access to Solera’s internal reports and finances so that he can investigate its plane purchases and Quagliano’s flights. Salazar has a background in accounting and owns Solera stock.

“A single-branch community bank has no apparent need for any aircraft, let alone a veritable airline,” he alleged in the lawsuit. “That decision, standing alone, sounds in waste.”

Reached by BusinessDen soon after the lawsuit was filed, Quagliano denied using Solera’s jets to travel to Nuggets games and said the bank’s aircraft are leased to flight schools, resulting in a tax deduction and “very, very good return” for Solera. He called Salazar a liar.

“Whatever he’s entitled to, we’re going to give him,” Quagliano said. “I’ve got nothing to hide.”

Judge David’s ruling this month ends the case but also shines new light on what happened behind closed doors at Solera after its December 2020 announcement that it would be paying its first dividends and then its decision five months later to buy a $4.8 million jet instead.

David found that “an unnamed whistleblower” within Solera alerted the company’s audit committee about the “rushed” jet purchase, which was made against the advice of its CEO and without its board of directors’ approval. The board reacted by removing Quagliano as chairman and hiring a forensic accounting firm to review the airplane purchase.

That firm’s final report “noted numerous instances in which it appears that Quagliano used the aircraft for personal use without properly reimbursing the bank for the cost of said use,” according to David’s ruling. The report was shown to Quagliano in mid-2021.

“What a waste of (Solera) shareholders’ money,” the chairman responded. “This is a joke. Our own aviation tax consultant sanctioned and monitored the jet action.”

“I am so scared,” he said sarcastically, “I am not bothering to forward this to my attorney.”

One week later, Quagliano’s allies on the board of directors reappointed him executive chairman and set his annual salary at $500,000, according to David’s order. Solera has since purchased at least four more airplanes and a helicopter, according to the judge.

Salazar’s lawsuit did not seek damages from Solera, only a large trove of documents. David determined that he has a right to some, but not all, of what he wanted.

Solera must turn over flight logs for any company aircraft used by Quagliano or other bank executives, along with some documents related to purchase of the aircraft and the decision not to pay a dividend. But Salazar doesn’t have a right to investigate the bank’s capital levels, liquidity levels, or expenses for airplane maintenance and insurance, David said.

Solera Bank and its attorneys did not respond to requests for comment about the decision.

“I am very pleased with the outcome of this lawsuit,” Salazar told BusinessDen.

“Once we receive and review all information, we will determine next steps.”