A view of downtown Denver. (Courtesy Guerilla Capturing)

Nearly one out of every three floors of office space in downtown Denver is available.

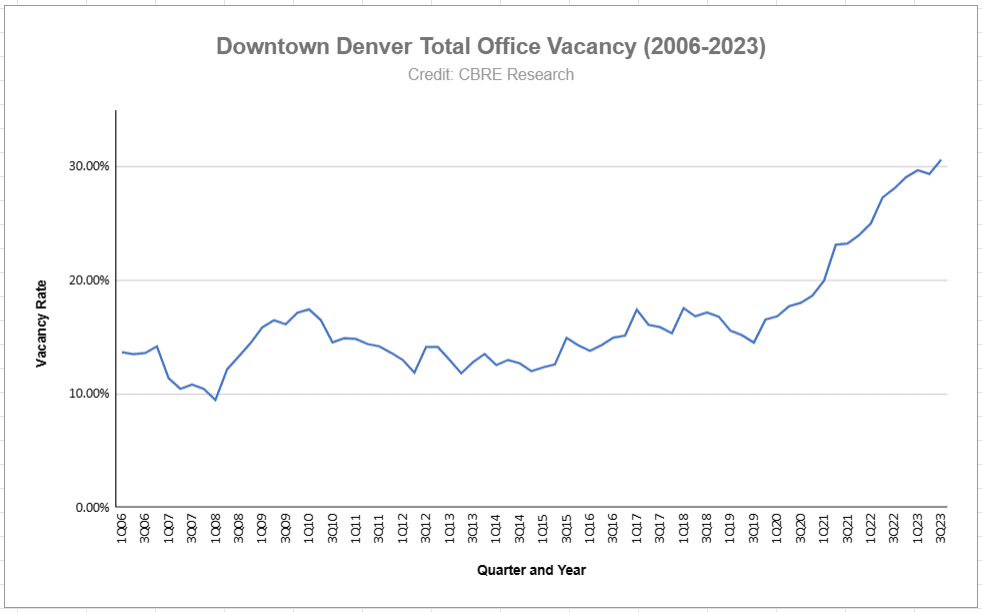

At the end of the third quarter, total office vacancy in the city’s core was 30.6 percent, according to CBRE.

The real estate services firm said it’s the first time downtown total vacancy has hit 30 percent “in the post-2000 era.” A spokeswoman provided quarterly figures going back to 2006, which show vacancy was as low as 9.5 percent in early 2008 and during the Great Recession went only as high as 17.4 percent.

The rate didn’t top 20 percent until the first quarter of 2021, as the effects of the pandemic set in on the office market. The 30 percent mark came just two-and-a-half years later.

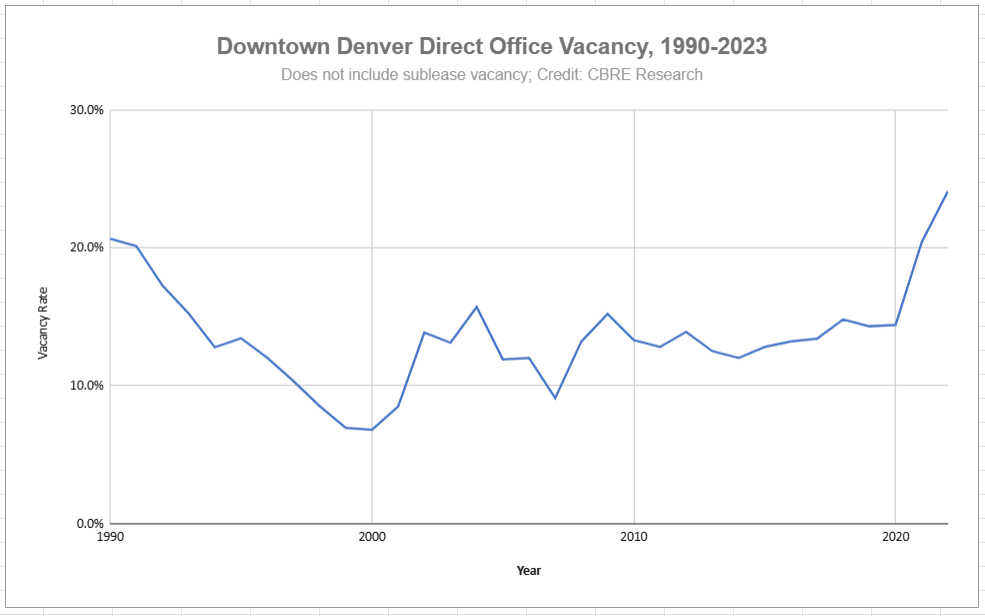

“Total vacancy” includes both “direct vacancy,” which is space no one uses that a landlord is marketing, in addition to sublease space, which is being marketed by a tenant that wants to vacate. Direct vacancy downtown was 26 percent at the end of the third quarter.

CBRE broker Allison Berry, who represents downtown landlords, noted it’s not as if something changed overnight. Total vacancy was up 1.3 percentage points from the second quarter and 2 percentage points from the same time last year.

“We’ve kind of been in this position for a few years now,” Berry said.

But 30 percent “is a psychological number,” said Jim Tyler, a broker with Kentwood Commercial who represents tenants seeking space.

Tyler, 60, said downtown Denver hasn’t hit 30 percent since 1990, shortly after he started working in the research department of what is now CBRE. The energy industry had contracted after a decade that saw multiple new towers like Tabor Center and Republic Plaza built.

“It’s a historic mark,” Tyler said.

CBRE’s definition of “downtown” includes the Central Business District and LoDo, as well as LoHi’s Platte Street and a portion of Uptown. It doesn’t include RiNo, Cherry Creek or other spots farther afield.

Total downtown vacancy was 16.5 percent at the end of 2019. The rate has been steadily increasing since the onset of the COVID pandemic, which prompted many companies to rethink their use of office space. Other factors like homelessness and crime, as well as increased development in Cherry Creek, are seen as playing a role in downtown’s numbers as well.

TOTAL VACANCY: This chart shows total office vacancy in downtown Denver on a quarterly basis from 2006 to the third quarter of 2023. Total vacancy includes both direct vacancy and sublease vacancy. (Data courtesy CBRE Research; Chart by BusinessDen)

A representative of JLL, another massive real estate services firm, confirmed that its own research also shows downtown Denver has hit the 30 percent mark. A local executive noted that other parts of the metro area are doing better.

“Our suburban markets are notably tighter — 10 percentage points lower, in fact — and resting below suburban vacancies across a good number of cities throughout the US. JLL data indicates an overall vacancy rate of 22.9 percent, which is in line with the national average among primary markets,” JLL Research Director TJ Jaroszewski said in a statement.

The pandemic has prompted a real estate industry maxim dubbed the “flight to quality,” which states that firms that do want office space want the best possible version of it.

Office buildings are assigned a letter grade meant to correspond to their desirability. Class “A” buildings are often the newest, offering the most in-demand layouts and amenities. Over time, buildings see their grade naturally decline, although owners often undertake renovations to counteract that.

CBRE’s research found that Class B and C office buildings are the drivers behind downtown’s rising vacancy, with those buildings collectively having vacancy of 35.5 percent at the end of the third quarter, up 2.8 percentage points year over year.

Class A buildings were 23.1 percent vacant, up just 0.6 percentage points since the same quarter in 2022.

Allison Berry

“Unfortunately there’s winners and losers,” Berry said. “Thirty percent is obviously a number we never want to see, but there are some bright spots.”

Berry said the downtown rate is also affected by some buildings being “essentially unable to transact right now” due to being in foreclosure or distressed in some other way.

“It’s a drag on the statistics but it’s not a drag on the market because they’re not really competing for deals,” she said.

Despite the uptick, CBRE’s research found that average asking rent for downtown office space has remained relatively constant for the last year. Berry said some landlords are willing to make deals, but they’re more likely to offer incentives like free rent or covering buildout costs — both generally more exciting to tenants than a lower base rent.

Tyler said, “It’s never been a better time to get concessions.”

Jim Tyler

“There are some deals out there, but you’ve got to shop to find them … It’s not every building, and it’s not every corner,” he said.

In the early 1990s, Tyler said, downtown recovered in part because no one built new office space for years, allowing the oversupply to gradually lease up.

This time around, however, some are still breaking ground. A half-dozen smaller office buildings are under construction in Cherry Creek and RiNo. And in April 2022, a Chicago-based developer broke ground on a 30-story, 700,000-square-foot tower downtown.

The law firm Gibson, Dunn & Crutcher has taken the top floor at 1900 Lawrence. But no additional leases have been announced since last November. The tower is not included in downtown’s vacancy figures because it’s not completed; it’s expected to wrap up next year.

Tyler said the 30 percent figure may understate downtown’s challenges, because some companies signed leases pre-pandemic and now aren’t using the space, but aren’t bothering to market it for sublease.

“There’s a lot of what I would call ‘ghost space’ — space being paid for and not being occupied, and they haven’t made decisions,” he said.

Berry, meanwhile, said she’s hoping for a quick recovery — but it probably doesn’t start just yet.

“I think there might be a little more pain,” she said.

DIRECT VACANCY: This chart shows direct office vacancy in downtown Denver from 1990 to 2023, with one figure per year. 2023 is represented by the Q3 figure of 26 percent. Direct vacancy refers to space being marketed by a landlord and does not include sublease vacancy. (Data courtesy CBRE Research; Chart by BusinessDen)

A view of downtown Denver. (Courtesy Guerilla Capturing)

Nearly one out of every three floors of office space in downtown Denver is available.

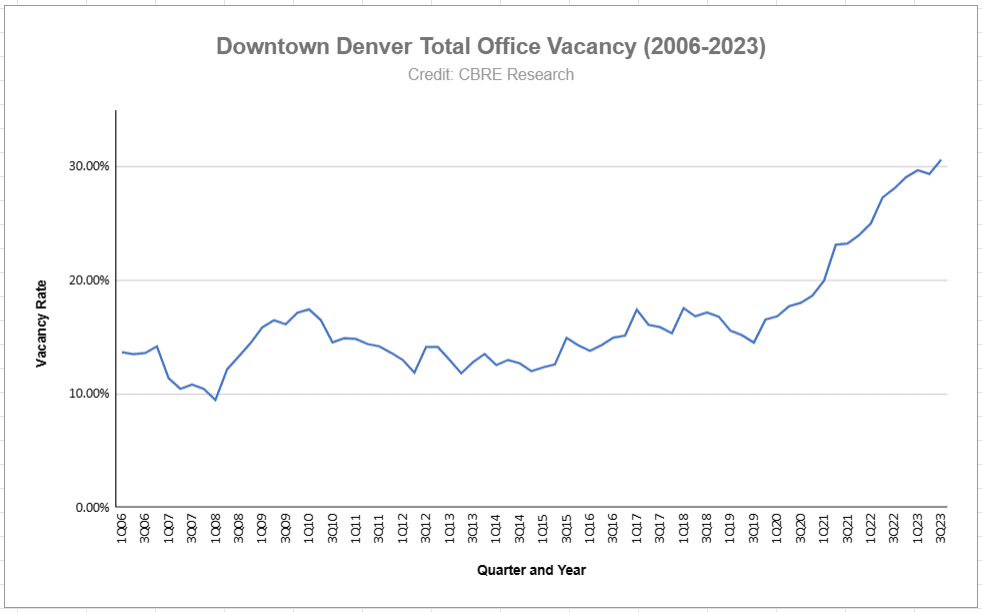

At the end of the third quarter, total office vacancy in the city’s core was 30.6 percent, according to CBRE.

The real estate services firm said it’s the first time downtown total vacancy has hit 30 percent “in the post-2000 era.” A spokeswoman provided quarterly figures going back to 2006, which show vacancy was as low as 9.5 percent in early 2008 and during the Great Recession went only as high as 17.4 percent.

The rate didn’t top 20 percent until the first quarter of 2021, as the effects of the pandemic set in on the office market. The 30 percent mark came just two-and-a-half years later.

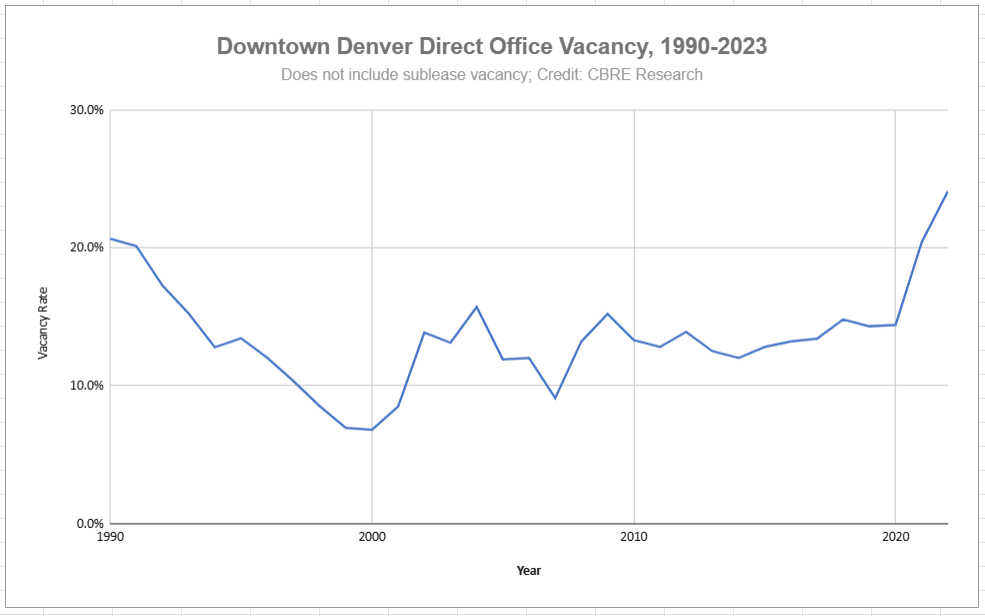

“Total vacancy” includes both “direct vacancy,” which is space no one uses that a landlord is marketing, in addition to sublease space, which is being marketed by a tenant that wants to vacate. Direct vacancy downtown was 26 percent at the end of the third quarter.

CBRE broker Allison Berry, who represents downtown landlords, noted it’s not as if something changed overnight. Total vacancy was up 1.3 percentage points from the second quarter and 2 percentage points from the same time last year.

“We’ve kind of been in this position for a few years now,” Berry said.

But 30 percent “is a psychological number,” said Jim Tyler, a broker with Kentwood Commercial who represents tenants seeking space.

Tyler, 60, said downtown Denver hasn’t hit 30 percent since 1990, shortly after he started working in the research department of what is now CBRE. The energy industry had contracted after a decade that saw multiple new towers like Tabor Center and Republic Plaza built.

“It’s a historic mark,” Tyler said.

CBRE’s definition of “downtown” includes the Central Business District and LoDo, as well as LoHi’s Platte Street and a portion of Uptown. It doesn’t include RiNo, Cherry Creek or other spots farther afield.

Total downtown vacancy was 16.5 percent at the end of 2019. The rate has been steadily increasing since the onset of the COVID pandemic, which prompted many companies to rethink their use of office space. Other factors like homelessness and crime, as well as increased development in Cherry Creek, are seen as playing a role in downtown’s numbers as well.

TOTAL VACANCY: This chart shows total office vacancy in downtown Denver on a quarterly basis from 2006 to the third quarter of 2023. Total vacancy includes both direct vacancy and sublease vacancy. (Data courtesy CBRE Research; Chart by BusinessDen)

A representative of JLL, another massive real estate services firm, confirmed that its own research also shows downtown Denver has hit the 30 percent mark. A local executive noted that other parts of the metro area are doing better.

“Our suburban markets are notably tighter — 10 percentage points lower, in fact — and resting below suburban vacancies across a good number of cities throughout the US. JLL data indicates an overall vacancy rate of 22.9 percent, which is in line with the national average among primary markets,” JLL Research Director TJ Jaroszewski said in a statement.

The pandemic has prompted a real estate industry maxim dubbed the “flight to quality,” which states that firms that do want office space want the best possible version of it.

Office buildings are assigned a letter grade meant to correspond to their desirability. Class “A” buildings are often the newest, offering the most in-demand layouts and amenities. Over time, buildings see their grade naturally decline, although owners often undertake renovations to counteract that.

CBRE’s research found that Class B and C office buildings are the drivers behind downtown’s rising vacancy, with those buildings collectively having vacancy of 35.5 percent at the end of the third quarter, up 2.8 percentage points year over year.

Class A buildings were 23.1 percent vacant, up just 0.6 percentage points since the same quarter in 2022.

Allison Berry

“Unfortunately there’s winners and losers,” Berry said. “Thirty percent is obviously a number we never want to see, but there are some bright spots.”

Berry said the downtown rate is also affected by some buildings being “essentially unable to transact right now” due to being in foreclosure or distressed in some other way.

“It’s a drag on the statistics but it’s not a drag on the market because they’re not really competing for deals,” she said.

Despite the uptick, CBRE’s research found that average asking rent for downtown office space has remained relatively constant for the last year. Berry said some landlords are willing to make deals, but they’re more likely to offer incentives like free rent or covering buildout costs — both generally more exciting to tenants than a lower base rent.

Tyler said, “It’s never been a better time to get concessions.”

Jim Tyler

“There are some deals out there, but you’ve got to shop to find them … It’s not every building, and it’s not every corner,” he said.

In the early 1990s, Tyler said, downtown recovered in part because no one built new office space for years, allowing the oversupply to gradually lease up.

This time around, however, some are still breaking ground. A half-dozen smaller office buildings are under construction in Cherry Creek and RiNo. And in April 2022, a Chicago-based developer broke ground on a 30-story, 700,000-square-foot tower downtown.

The law firm Gibson, Dunn & Crutcher has taken the top floor at 1900 Lawrence. But no additional leases have been announced since last November. The tower is not included in downtown’s vacancy figures because it’s not completed; it’s expected to wrap up next year.

Tyler said the 30 percent figure may understate downtown’s challenges, because some companies signed leases pre-pandemic and now aren’t using the space, but aren’t bothering to market it for sublease.

“There’s a lot of what I would call ‘ghost space’ — space being paid for and not being occupied, and they haven’t made decisions,” he said.

Berry, meanwhile, said she’s hoping for a quick recovery — but it probably doesn’t start just yet.

“I think there might be a little more pain,” she said.

DIRECT VACANCY: This chart shows direct office vacancy in downtown Denver from 1990 to 2023, with one figure per year. 2023 is represented by the Q3 figure of 26 percent. Direct vacancy refers to space being marketed by a landlord and does not include sublease vacancy. (Data courtesy CBRE Research; Chart by BusinessDen)