Meati Foods co-founder and Chief Technology Officer Justin Whiteley and co-founder and CEO Tyler Huggins. Meati Foods raised $50 million in July. (Courtesy of Meati Foods)

Colorado startup funding in July was up $110 million from last year.

According to a tally of Form Ds filed with the SEC last month, 31 startups around the state raised a total of $188.5 million, compared to July 2020’s $78.5 million. It was also up from July 2019’s $108 million. (You can see our sortable spreadsheet here.)

BusinessDen defines a startup as a business that’s less than 10 years old and excludes publicly traded companies, real estate ventures and funds.

Denver startups led the way with $90.2 million raised among 13 deals. Boulder-based startups raised $76.6 million among eight deals, and startups elsewhere garnered $21.6 million among 10 deals.

Here are some highlights from July:

Meati Foods (Emergy Inc.): $50 million

Boulder-based Meati Foods, which was founded as Emergy Inc. and is developing plant-based alternative meats, raised $50 million last month in a round co-led by new investor BOND and long-time Meati investor Acre Venture Partners. They were joined by other existing investors, including Prelude Ventures, Congruent Ventures and Tao Capital.

The startup plans to use the funding, in addition to the $18 million in debt financing it announced in April, to build out its new production facility in Thornton. Read more from BusinessDen news partner BizWest.com.

Quinn Snacks sells organic microwave popcorn, pretzels made with whole grain and gluten-free sorghum and gluten-free peanut-butter-filled pretzel nuggets. (Courtesy of Quinn Snacks)

Quinn (Quinn Foods LLC): $10 million

Boulder-based Quinn Foods LLC, which operates under the name Quinn, raised $10 million last month.

The funding round was led by Arkansas-based NewRoad Capital Partners with participation from existing investors Boulder Food Group, California-based Echo Capital, and Sunil Thakor of Virginia-based Sands Capital.

The company’s products are sold in more than 7,000 stores nationwide, including major retailers such as Walmart, Whole Foods Market, Kroger and Wegmans. They also retail online at places like Thrive Market, HungryRoot and Imperfect Foods.

Quinn Snacks has seen 60 percent growth in revenue year over year since 2019, according to a news release.

This funding round follows an October 2020 Series D round that featured an investment from The Hershey Co.

Sustainable Beverage Technologies, formerly Pat’s Backcountry Beverages, rebranded in 2019. (Courtesy of Sustainable Beverage Technologies)

Sustainable Beverage Technologies: $5 million

Golden-based Sustainable Beverage Technologies, formerly known as Pat’s Backcountry Beverages, has created a process to brew beer at six times its traditional density, which allows the beer to be distributed and served in a bag-in-box format (like soft drinks).

The company raised $5 million last month to scale its production within Denver-based Sleeping Giant’s contract brewing facility. BusinessDen spoke to CEO Gary Tickle for a story published Aug. 2.

Guest House raised $3 million that will go toward expanding its home staging services in other states. (Courtesy of Guest House)

Guest House (Eliot Street Inc.): $3 million

Denver-based Guest House, a home staging startup, raised $3 million last month to expand into other states and integrate services needed to fully list homes for sale.

BusinessDen spoke to founder Alex Ryden for a story published Aug. 9.

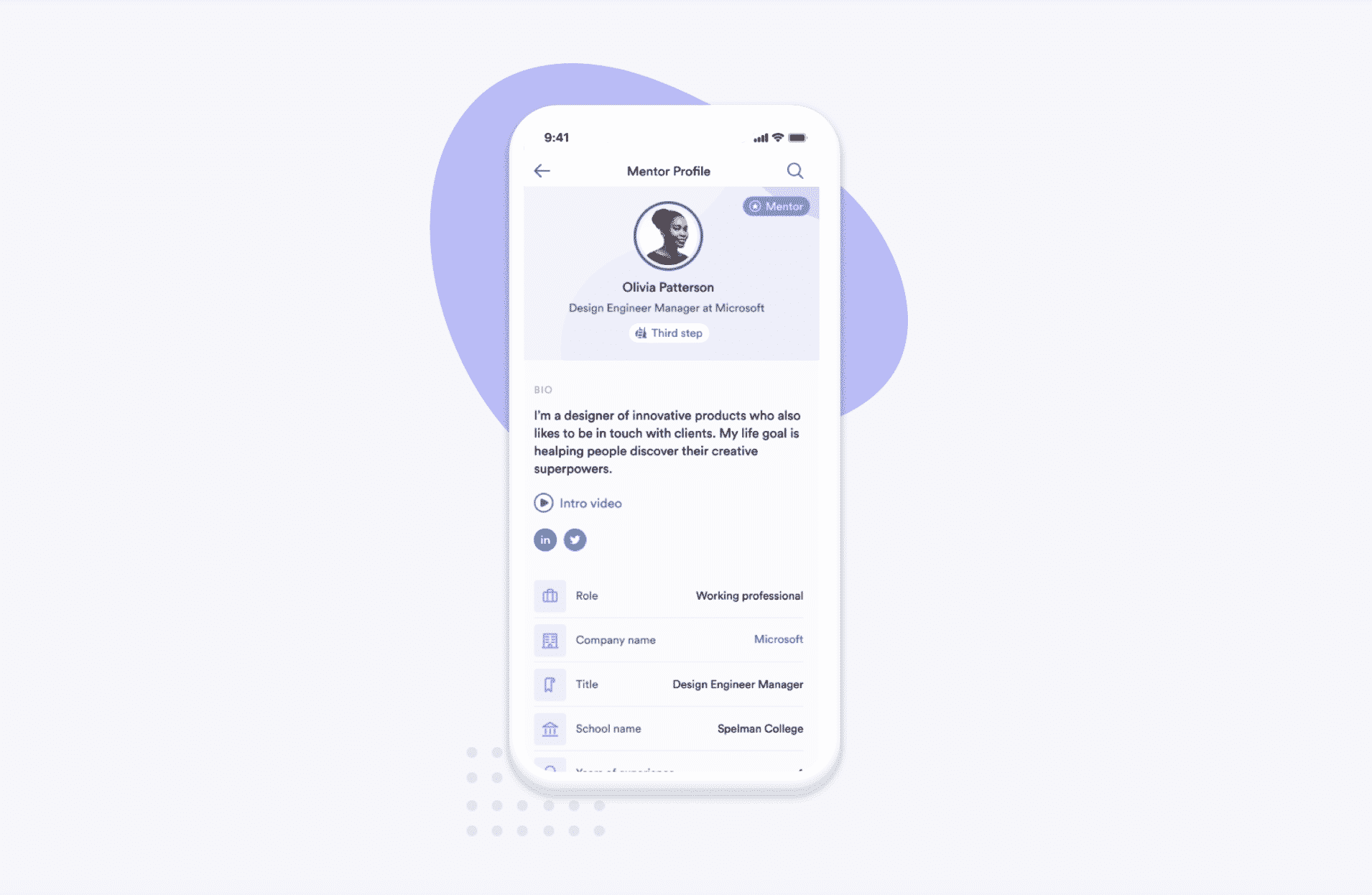

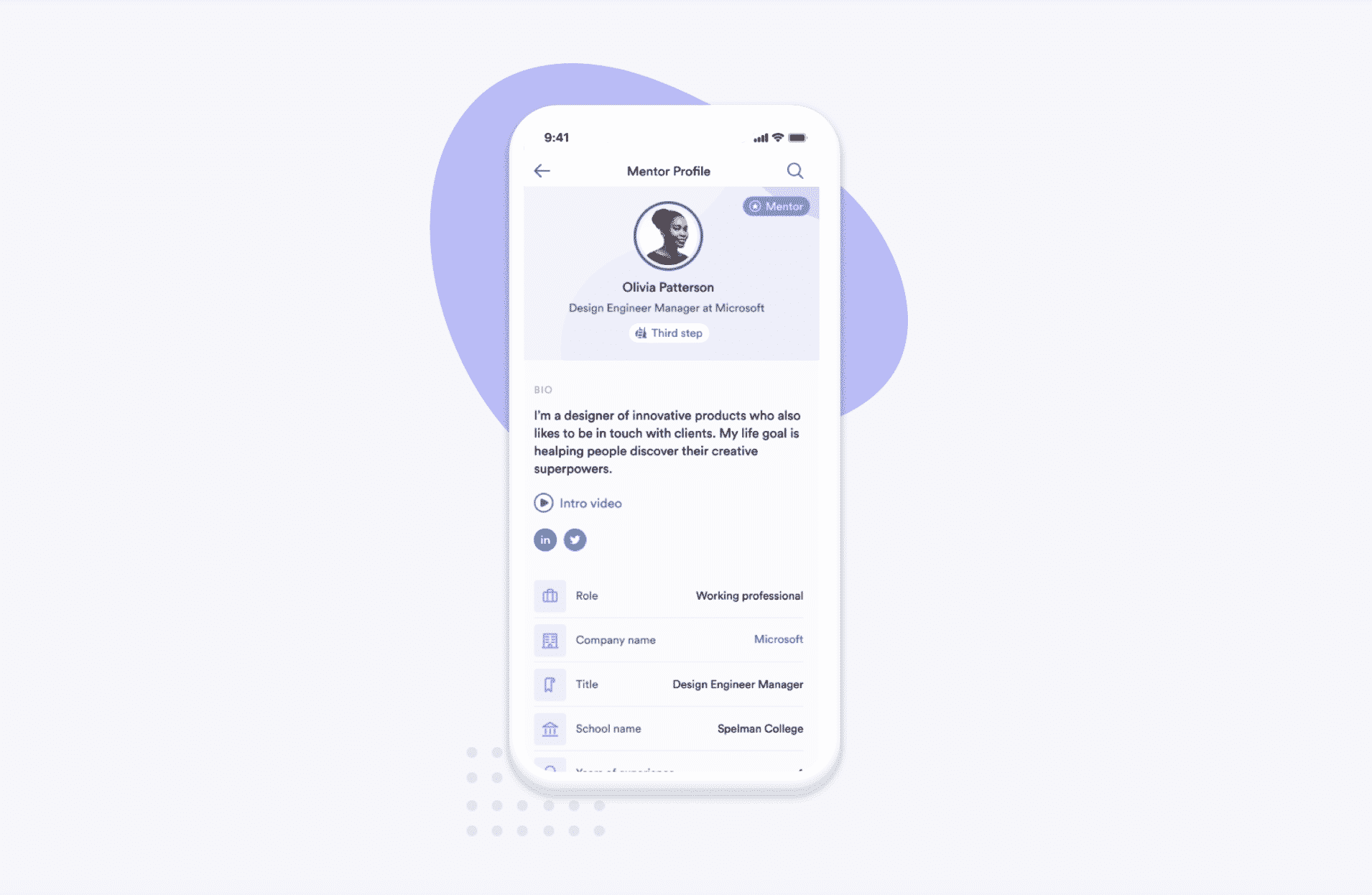

Mentors and mentees can create a profile on Mentor Spaces and get matched based on personal and professional goals and interests. (Photos courtesy of Mentor Spaces)

Mentor Spaces (BetterWeekdays Inc.): $2.4 million

Chris Motley said he wouldn’t be where he is today without the mentors that helped him along the way.

“As a black kid from the South Side of Chicago with a teenaged single mother, there was no way I could have navigated to a career at Goldman Sachs had I not had a conversation with someone who worked there or in the industry,” he said. “A person can’t be who they haven’t seen.”

That’s why last summer he launched Denver-based Mentor Spaces, a website that connects mentees with mentors from a variety of industries.

In July, Mentor Spaces closed on its first funding round of $2.4 million to scale its technology and build its brand and sales efforts, as well as expand its team.

“Companies large and small are still trying to figure out how to better attract, hire and retain underrepresented talent, and from my perspective, if people still complain about that problem the other solutions must not work that well,” Motley said. “Some are spending $8 billion annually on diversity programs.”

Mentor Spaces, which has an office at 1040 S. Gaylord St. in Wash Park, has a staff of five and plans to add six more employees over the next year.

The startup was born out of a previous failed venture called The Whether, an app that matched users to open job opportunities. Motley went back to the drawing board to learn where he went wrong through research partly funded by the Bill and Melinda Gates Foundation.

“We learned that someone who doesn’t feel confident about that industry or job won’t use the app,” Motley said. “So we wanted to create a product that builds confidence and a social network that’s also sustainable.”

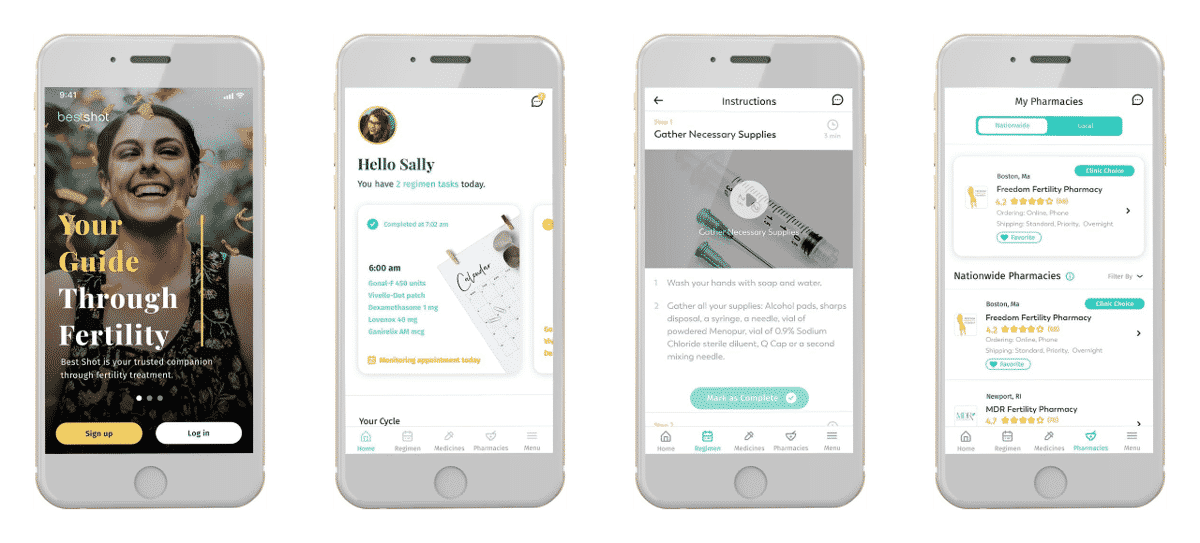

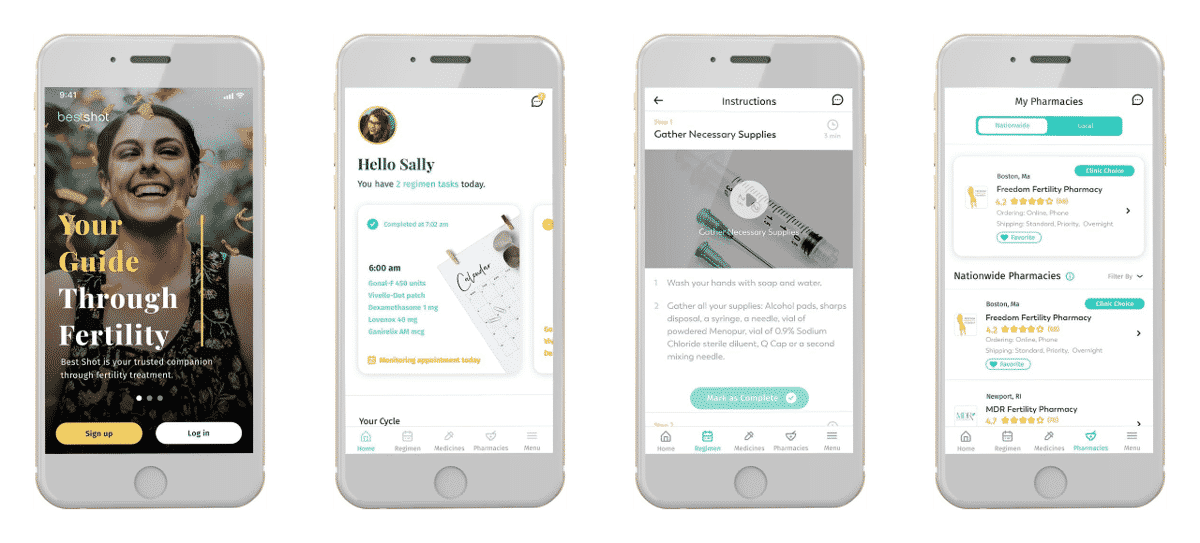

Best Shot Care has rebranded under the name Rescripted as a result of a merger with The Fertility Tribe. (Courtesy of Best Shot Care)

Best Shot Care Inc.: $1.96 million

Best Shot, a Denver-based fertility medication management and group therapy website, raised $1.96 million last month ahead of a recent merger and rebrand with The Fertility Tribe, an online fertility community.

The funding round was backed by angel investors. More than 40 percent of the company’s supporters have experienced IVF first-hand, and nearly half of the capital raise is funded by women, according to the release.

Abby Mercado launched Best Shot last year after she miscarried as a result of an error while administering an IVF treatment. She was determined to address gaps in fertility patient care, particularly regarding medication management, to help others avoid making mistakes that could be similarly detrimental to their treatment outcome.

Best Shot focused initially on medication management, then launched a small group therapy component last spring when clinics temporarily closed in response to the pandemic.

Meati Foods co-founder and Chief Technology Officer Justin Whiteley and co-founder and CEO Tyler Huggins. Meati Foods raised $50 million in July. (Courtesy of Meati Foods)

Colorado startup funding in July was up $110 million from last year.

According to a tally of Form Ds filed with the SEC last month, 31 startups around the state raised a total of $188.5 million, compared to July 2020’s $78.5 million. It was also up from July 2019’s $108 million. (You can see our sortable spreadsheet here.)

BusinessDen defines a startup as a business that’s less than 10 years old and excludes publicly traded companies, real estate ventures and funds.

Denver startups led the way with $90.2 million raised among 13 deals. Boulder-based startups raised $76.6 million among eight deals, and startups elsewhere garnered $21.6 million among 10 deals.

Here are some highlights from July:

Meati Foods (Emergy Inc.): $50 million

Boulder-based Meati Foods, which was founded as Emergy Inc. and is developing plant-based alternative meats, raised $50 million last month in a round co-led by new investor BOND and long-time Meati investor Acre Venture Partners. They were joined by other existing investors, including Prelude Ventures, Congruent Ventures and Tao Capital.

The startup plans to use the funding, in addition to the $18 million in debt financing it announced in April, to build out its new production facility in Thornton. Read more from BusinessDen news partner BizWest.com.

Quinn Snacks sells organic microwave popcorn, pretzels made with whole grain and gluten-free sorghum and gluten-free peanut-butter-filled pretzel nuggets. (Courtesy of Quinn Snacks)

Quinn (Quinn Foods LLC): $10 million

Boulder-based Quinn Foods LLC, which operates under the name Quinn, raised $10 million last month.

The funding round was led by Arkansas-based NewRoad Capital Partners with participation from existing investors Boulder Food Group, California-based Echo Capital, and Sunil Thakor of Virginia-based Sands Capital.

The company’s products are sold in more than 7,000 stores nationwide, including major retailers such as Walmart, Whole Foods Market, Kroger and Wegmans. They also retail online at places like Thrive Market, HungryRoot and Imperfect Foods.

Quinn Snacks has seen 60 percent growth in revenue year over year since 2019, according to a news release.

This funding round follows an October 2020 Series D round that featured an investment from The Hershey Co.

Sustainable Beverage Technologies, formerly Pat’s Backcountry Beverages, rebranded in 2019. (Courtesy of Sustainable Beverage Technologies)

Sustainable Beverage Technologies: $5 million

Golden-based Sustainable Beverage Technologies, formerly known as Pat’s Backcountry Beverages, has created a process to brew beer at six times its traditional density, which allows the beer to be distributed and served in a bag-in-box format (like soft drinks).

The company raised $5 million last month to scale its production within Denver-based Sleeping Giant’s contract brewing facility. BusinessDen spoke to CEO Gary Tickle for a story published Aug. 2.

Guest House raised $3 million that will go toward expanding its home staging services in other states. (Courtesy of Guest House)

Guest House (Eliot Street Inc.): $3 million

Denver-based Guest House, a home staging startup, raised $3 million last month to expand into other states and integrate services needed to fully list homes for sale.

BusinessDen spoke to founder Alex Ryden for a story published Aug. 9.

Mentors and mentees can create a profile on Mentor Spaces and get matched based on personal and professional goals and interests. (Photos courtesy of Mentor Spaces)

Mentor Spaces (BetterWeekdays Inc.): $2.4 million

Chris Motley said he wouldn’t be where he is today without the mentors that helped him along the way.

“As a black kid from the South Side of Chicago with a teenaged single mother, there was no way I could have navigated to a career at Goldman Sachs had I not had a conversation with someone who worked there or in the industry,” he said. “A person can’t be who they haven’t seen.”

That’s why last summer he launched Denver-based Mentor Spaces, a website that connects mentees with mentors from a variety of industries.

In July, Mentor Spaces closed on its first funding round of $2.4 million to scale its technology and build its brand and sales efforts, as well as expand its team.

“Companies large and small are still trying to figure out how to better attract, hire and retain underrepresented talent, and from my perspective, if people still complain about that problem the other solutions must not work that well,” Motley said. “Some are spending $8 billion annually on diversity programs.”

Mentor Spaces, which has an office at 1040 S. Gaylord St. in Wash Park, has a staff of five and plans to add six more employees over the next year.

The startup was born out of a previous failed venture called The Whether, an app that matched users to open job opportunities. Motley went back to the drawing board to learn where he went wrong through research partly funded by the Bill and Melinda Gates Foundation.

“We learned that someone who doesn’t feel confident about that industry or job won’t use the app,” Motley said. “So we wanted to create a product that builds confidence and a social network that’s also sustainable.”

Best Shot Care has rebranded under the name Rescripted as a result of a merger with The Fertility Tribe. (Courtesy of Best Shot Care)

Best Shot Care Inc.: $1.96 million

Best Shot, a Denver-based fertility medication management and group therapy website, raised $1.96 million last month ahead of a recent merger and rebrand with The Fertility Tribe, an online fertility community.

The funding round was backed by angel investors. More than 40 percent of the company’s supporters have experienced IVF first-hand, and nearly half of the capital raise is funded by women, according to the release.

Abby Mercado launched Best Shot last year after she miscarried as a result of an error while administering an IVF treatment. She was determined to address gaps in fertility patient care, particularly regarding medication management, to help others avoid making mistakes that could be similarly detrimental to their treatment outcome.

Best Shot focused initially on medication management, then launched a small group therapy component last spring when clinics temporarily closed in response to the pandemic.