Opendoor paid $473,600 in December for this home at 7040 S. Ukraine St. in Aurora. The company sold it in late April, for $465,000. (Photos courtesy Opendoor)

Derrick Lewsader was scrolling through Facebook this past winter when an ad popped up for Opendoor.

The company is the largest of the “iBuyers,” algorithm-driven home-flipping companies that buy properties and re-list them for sale within days after doing minimal improvements. Opendoor, which said it is buying a home somewhere in America every 34 minutes, launched in the Denver area last fall.

The thought of selling his 1,534-square-foot Castle Rock home with just a few clicks of a button intrigued Lewsader. Especially compelling, he said, was that he could sell without doing any showings.

“Who wants to have a whole bunch of people walking through their personal belongings?” Lewsader said.

Opendoor made Lewsader an offer and let him pick the closing date. In late April, the company purchased his home for $358,900, records show.

“It was easy,” he said. “They made a competitive offer.”

Opendoor paid $302,600 for this home at 3892 Odessa St. in Denver. It’s listed it for sale at $313,000.

Lewsader said the sale price was $14,000 more than his home’s estimate on Zillow, which has its own iBuyer division, known as Zillow Offers. He said he also saved on real estate commissions, since he didn’t need an agent and Opendoor acted as its own agent. The company charged him a 5 percent fee upon closing, according to Lewsader.

“The whole thing cost me less than what it would have to have two agents,” Lewsader said.

Lewsader’s home is one of 201 that Opendoor had purchased locally as of mid-May, a period that roughly corresponds with the company’s first six months in the Denver market, according to a BusinessDen review of public records. During the same period, Opendoor re-sold 79 of those homes.

On average, Opendoor sold the homes for $7,844 more than the company paid for them — but, on 17 occasions, Opendoor has sold a home for less than its purchase price, the review found. That doesn’t necessarily mean Opendoor lost money on a particular deal, however, because it doesn’t account for the fee the company charges sellers when it buys their home. Opendoor itself said it isn’t trying to maximize the gain it sees when it sells.

“The goal’s not to make a lot of money in the resale of the home itself,” PJ O’Neil, Opendoor’s Denver general manager, told BusinessDen. “The fee is really where we make our money.”

For now, Lewsader is living in a Castle Rock apartment while his next home is built. He recently saw that Opendoor had relisted his home for $5,100 more than what the company paid.

“I don’t see how they’re going to make money, but then I quickly convinced myself that’s none of my business,” he said.

Here’s a more detailed breakdown of Opendoor’s first six months in Denver:

201 homes

Opendoor purchased its first home in the metro area on Nov. 8, spending $347,000 for a brick two-bedroom home in Westminster. The company sold it two months later, for $370,500.

BusinessDen’s review found that the average price Opendoor paid for a home through mid-May is $373,767. The company has paid as little as $158,600 for a 952-square-foot townhouse in Thornton, and as much as $542,500 for a three-bedroom home in Aurora.

Opendoor said it generally targets residences built since 1960, and those that are less than $600,000. Locally, the company has bought condominiums and townhomes as well as detached single-family homes.

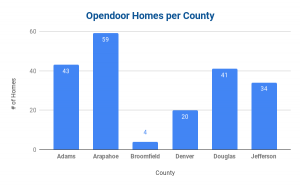

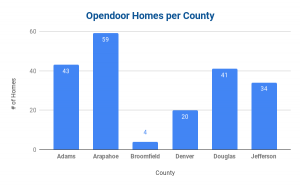

Opendoor is targeting homes in the suburbs, with those in Arapahoe County currently leading the list. Click to enlarge.

Opendoor has bought homes in all six counties that comprise the Denver metropolitan area, with an emphasis on the suburbs. The company has bought 59 homes in Arapahoe County, 43 in Adams County, 41 homes in Douglas County, 34 homes in Jefferson County, 20 homes in Denver County and four homes in Broomfield County. In total, it’s spent $75.13 million, records show.

The company has made few purchases within the core of Denver, where apartment buildings are more common, and the homes and condos on the market are more likely to be pre-1960, or priced above Opendoor’s preferred range.

79 sales

Opendoor’s biggest win, at least from an outsider’s perspective, came in February, when it sold a four-bedroom home in Green Valley Ranch for $393,000 — $41,000 more than the company paid for the home in November.

That’s not the norm. As of mid-May, Opendoor has sold 79 of the homes it bought, for an average gain of $7,844.

The company’s algorithm appears to swing and miss at times. Opendoor has sold 17 homes at a loss, which is 21 percent of its flips. The company bought a townhome on Dayton Circle in Aurora for $366,300 in early December. It didn’t unload the property for 175 days, until early May — and the buyer paid $21,300 less.

On average, it has taken Opendoor 72 days to sell its Denver-area homes. That figure doesn’t take into account homes that the company purchased early on but hasn’t managed to flip. The company still owns seven of the 24 homes it bought in January, for example.

Opendoor bought this home at 6508 S. Garland Way in Littleton in early May for $404,800. It’s listed it for sale at $416,000.

Fees charged to sellers, which vary, are focus

The difference between what Opendoor pays for a home and what it sells it for is only part of the picture when it comes to the company’s revenue.

Opendoor also charges the people it buys homes from a fee, which varies depending on transaction. Owners of homes that the company’s algorithm predicts will sell quickly, like a $350,000 home in Highlands Ranch, will be charged a lower fee than homes predicted to take longer to sell, like a $550,000 home in Parker or Castle Rock, O’Neil said.

O’Neil said that Denver-area homeowners selling to Opendoor now are being charged an 8 percent fee on average — equivalent to $32,000 for a $400,000 home — compared to 6 percent in January. If Opendoor decides repairs are needed before the home can be resold, sellers are typically charged the cost of those repairs on top of the fee, he said.

The company uses the fee money to, among other things, pay title and escrow costs, costs to maintain the home and the commission of the agent working with the person who buys the home from Opendoor. O’Neil openly states that the company’s profit on any given deal is small, because the company is focusing on growth.

“The profit margin is very, very slim on that, so that we can get as many sellers as possible,” he said.

O’Neil said the difference between what Opendoor pays for a home and what it sells a home for is less of a priority. An average gain of $7,844 of an average home purchase of $373,767 is close to 2 percent — which O’Neil said is roughly similar to the appreciation that Denver-area homes have seen in the months that Opendoor has been in Denver.

“When we resell it, the goal is really to match the market,” he said.

Selling 17 Denver-area homes for less than what it paid for them is higher than optimal, O’Neil said. But accounting for the fee, it’s likely the company didn’t lose money on all of those transactions, he said.

Six months in, “We’re still reining in our pricing practices,” O’Neil said. “We’re getting a lot better at this in Denver.”

If Opendoor’s fees sound high, O’Neil said, it’s worth considering what costs the company may be helping sellers avoid, such as commissions for a buying and selling agent (Opendoor doesn’t use outside agents when it buys a home), costs associated with a potential sale falling through and the risk of needing to pay two mortgages if the seller is buying another home.

Opendoor may also have additional revenue streams in Denver in the future. The company has established a website for Opendoor Mortgage, which would make loans to those buying homes. O’Neil said that company of the business is not active in Denver, and a company spokesman said Opendoor isn’t discussing it at this time.

A $300 million funding round that closed in March valued Opendoor at $3.8 billion, according to TechCrunch.

BusinessDen reporter Kate Tracy contributed to this story.

How we reported this story: Opendoor has been making all its purchases in the Denver metro area as “Opendoor Property C LLC” or similarly named entities. BusinessDen staff reviewed all purchases and sales made by those entities and recorded by Adams, Arapahoe, Broomfield, Denver, Douglas and Jefferson counties through May 17.

View our data: To view our resulting spreadsheet, with info on every single deal, click here.

Coming soon: BusinessDen’s analysis of Zillow Offers’ first six months in the Denver market publishes in early June.

Opendoor paid $473,600 in December for this home at 7040 S. Ukraine St. in Aurora. The company sold it in late April, for $465,000. (Photos courtesy Opendoor)

Derrick Lewsader was scrolling through Facebook this past winter when an ad popped up for Opendoor.

The company is the largest of the “iBuyers,” algorithm-driven home-flipping companies that buy properties and re-list them for sale within days after doing minimal improvements. Opendoor, which said it is buying a home somewhere in America every 34 minutes, launched in the Denver area last fall.

The thought of selling his 1,534-square-foot Castle Rock home with just a few clicks of a button intrigued Lewsader. Especially compelling, he said, was that he could sell without doing any showings.

“Who wants to have a whole bunch of people walking through their personal belongings?” Lewsader said.

Opendoor made Lewsader an offer and let him pick the closing date. In late April, the company purchased his home for $358,900, records show.

“It was easy,” he said. “They made a competitive offer.”

Opendoor paid $302,600 for this home at 3892 Odessa St. in Denver. It’s listed it for sale at $313,000.

Lewsader said the sale price was $14,000 more than his home’s estimate on Zillow, which has its own iBuyer division, known as Zillow Offers. He said he also saved on real estate commissions, since he didn’t need an agent and Opendoor acted as its own agent. The company charged him a 5 percent fee upon closing, according to Lewsader.

“The whole thing cost me less than what it would have to have two agents,” Lewsader said.

Lewsader’s home is one of 201 that Opendoor had purchased locally as of mid-May, a period that roughly corresponds with the company’s first six months in the Denver market, according to a BusinessDen review of public records. During the same period, Opendoor re-sold 79 of those homes.

On average, Opendoor sold the homes for $7,844 more than the company paid for them — but, on 17 occasions, Opendoor has sold a home for less than its purchase price, the review found. That doesn’t necessarily mean Opendoor lost money on a particular deal, however, because it doesn’t account for the fee the company charges sellers when it buys their home. Opendoor itself said it isn’t trying to maximize the gain it sees when it sells.

“The goal’s not to make a lot of money in the resale of the home itself,” PJ O’Neil, Opendoor’s Denver general manager, told BusinessDen. “The fee is really where we make our money.”

For now, Lewsader is living in a Castle Rock apartment while his next home is built. He recently saw that Opendoor had relisted his home for $5,100 more than what the company paid.

“I don’t see how they’re going to make money, but then I quickly convinced myself that’s none of my business,” he said.

Here’s a more detailed breakdown of Opendoor’s first six months in Denver:

201 homes

Opendoor purchased its first home in the metro area on Nov. 8, spending $347,000 for a brick two-bedroom home in Westminster. The company sold it two months later, for $370,500.

BusinessDen’s review found that the average price Opendoor paid for a home through mid-May is $373,767. The company has paid as little as $158,600 for a 952-square-foot townhouse in Thornton, and as much as $542,500 for a three-bedroom home in Aurora.

Opendoor said it generally targets residences built since 1960, and those that are less than $600,000. Locally, the company has bought condominiums and townhomes as well as detached single-family homes.

Opendoor is targeting homes in the suburbs, with those in Arapahoe County currently leading the list. Click to enlarge.

Opendoor has bought homes in all six counties that comprise the Denver metropolitan area, with an emphasis on the suburbs. The company has bought 59 homes in Arapahoe County, 43 in Adams County, 41 homes in Douglas County, 34 homes in Jefferson County, 20 homes in Denver County and four homes in Broomfield County. In total, it’s spent $75.13 million, records show.

The company has made few purchases within the core of Denver, where apartment buildings are more common, and the homes and condos on the market are more likely to be pre-1960, or priced above Opendoor’s preferred range.

79 sales

Opendoor’s biggest win, at least from an outsider’s perspective, came in February, when it sold a four-bedroom home in Green Valley Ranch for $393,000 — $41,000 more than the company paid for the home in November.

That’s not the norm. As of mid-May, Opendoor has sold 79 of the homes it bought, for an average gain of $7,844.

The company’s algorithm appears to swing and miss at times. Opendoor has sold 17 homes at a loss, which is 21 percent of its flips. The company bought a townhome on Dayton Circle in Aurora for $366,300 in early December. It didn’t unload the property for 175 days, until early May — and the buyer paid $21,300 less.

On average, it has taken Opendoor 72 days to sell its Denver-area homes. That figure doesn’t take into account homes that the company purchased early on but hasn’t managed to flip. The company still owns seven of the 24 homes it bought in January, for example.

Opendoor bought this home at 6508 S. Garland Way in Littleton in early May for $404,800. It’s listed it for sale at $416,000.

Fees charged to sellers, which vary, are focus

The difference between what Opendoor pays for a home and what it sells it for is only part of the picture when it comes to the company’s revenue.

Opendoor also charges the people it buys homes from a fee, which varies depending on transaction. Owners of homes that the company’s algorithm predicts will sell quickly, like a $350,000 home in Highlands Ranch, will be charged a lower fee than homes predicted to take longer to sell, like a $550,000 home in Parker or Castle Rock, O’Neil said.

O’Neil said that Denver-area homeowners selling to Opendoor now are being charged an 8 percent fee on average — equivalent to $32,000 for a $400,000 home — compared to 6 percent in January. If Opendoor decides repairs are needed before the home can be resold, sellers are typically charged the cost of those repairs on top of the fee, he said.

The company uses the fee money to, among other things, pay title and escrow costs, costs to maintain the home and the commission of the agent working with the person who buys the home from Opendoor. O’Neil openly states that the company’s profit on any given deal is small, because the company is focusing on growth.

“The profit margin is very, very slim on that, so that we can get as many sellers as possible,” he said.

O’Neil said the difference between what Opendoor pays for a home and what it sells a home for is less of a priority. An average gain of $7,844 of an average home purchase of $373,767 is close to 2 percent — which O’Neil said is roughly similar to the appreciation that Denver-area homes have seen in the months that Opendoor has been in Denver.

“When we resell it, the goal is really to match the market,” he said.

Selling 17 Denver-area homes for less than what it paid for them is higher than optimal, O’Neil said. But accounting for the fee, it’s likely the company didn’t lose money on all of those transactions, he said.

Six months in, “We’re still reining in our pricing practices,” O’Neil said. “We’re getting a lot better at this in Denver.”

If Opendoor’s fees sound high, O’Neil said, it’s worth considering what costs the company may be helping sellers avoid, such as commissions for a buying and selling agent (Opendoor doesn’t use outside agents when it buys a home), costs associated with a potential sale falling through and the risk of needing to pay two mortgages if the seller is buying another home.

Opendoor may also have additional revenue streams in Denver in the future. The company has established a website for Opendoor Mortgage, which would make loans to those buying homes. O’Neil said that company of the business is not active in Denver, and a company spokesman said Opendoor isn’t discussing it at this time.

A $300 million funding round that closed in March valued Opendoor at $3.8 billion, according to TechCrunch.

BusinessDen reporter Kate Tracy contributed to this story.

How we reported this story: Opendoor has been making all its purchases in the Denver metro area as “Opendoor Property C LLC” or similarly named entities. BusinessDen staff reviewed all purchases and sales made by those entities and recorded by Adams, Arapahoe, Broomfield, Denver, Douglas and Jefferson counties through May 17.

View our data: To view our resulting spreadsheet, with info on every single deal, click here.

Coming soon: BusinessDen’s analysis of Zillow Offers’ first six months in the Denver market publishes in early June.

This company will be out of business soon. I have seen the deals they are involved in and and I doubt the stated statistic of 21% at a loss is correct. It is much higher. 21% may be at a gross loss but those at a net loss must be higher. They pay way too much for houses and now that the market is softening they are going to get killed.

Hi Jay, reporter here. Just want to clarify a few things. The figure stating that Opendoor has sold 21 percent of the Denver-area homes it’s resold for less than what it paid for them is correct. We published our data, so you can see every transaction (see “View our data” under the map). That said, yes, that figure only accounts for the real estate. As the story notes, the fee is where Opendoor is trying to make money. That fee varies transaction by transaction and isn’t public, so we can’t calculate net loss or gain.

It is also important to keep in mind that the price offered is a “Wholesale” price then minus the fees. It isn’t fair to compare the price of Opendoor to what an agent might determine is the best price (lots of subjectivity here but if opendoor has to turn around and sell it, using wholesale and retail pricing references seems to be valid). If Opendoor offers $385,000 minus 5% (or 8%) that is worse than an agent selling for $400,000 and charging their fee. I’m an agent and own a brokerage and I’m not threatened by this model – our job is to provide amazing advice and expertise and if someone wants to close in 2 weeks, there is no way I can do that. The convenience is worth the lower returns in some cases. Opendoor is still trying to figure out their pricing and I have heard of some cases where that is actually above what a good agent would list it for. I feel this balances out over time but the wholesale price vs retail pricing is important to distinguish. Sorry to be posting this as a reply – the reply link wasn’t working.

Tom, thank you for a detailed article. The fee and assessed cost of repairs are certainly the biggest missing delta here. If you are talking to Opendoor and asking the company to comment on its model, why not ask what were the fees associated with every one of the purchases the article mentions? This will resolve any doubt with how much it costs and what this model actually is – a real estate investor. The article mentions that Opendoor represents consumers in a sale, but this is inaccurate. Opendoor represents itself and only itself. Opendoor has no legal obligation to represent consumers, this is a fact taken directly from company’s Terms of Service.

These statistics are also severely flawed because they are missing the core of the product – an idea that anyone at anytime is able to get a competitive offer from Opendoor. These are only a few successful transactions, where the offer was likely good enough to take. Most people who go to Opendoor get highly unattractive terms and simply decline them. Zillow Offers, for example, had sold 600-700 homes in 2018, but it has received about 60,000 requests – this is a failure rate of 98%. What does Zillow and Opendoor do with these failed requests – they sell them to real estate agents for undisclosed 30%-40% in referral fees. If you are taking a serious look at the direct Cash Buyer model, this is a good place to begin https://homeopenly.com/Reviews/Compare-Zillow_Offers-Opendoor

It is important to understand this difference because iBuyers operate in a “black box. Consumers looking into this model can never assume that the company has their best interest in mind because iBuyer has only one legal obligation – to deliver returns to shareholders. In reality, Opendoor and Zillow actively engage in bait-and-switch sales tactics, looking to sell majority of their failed requests as leads to referral agents. US consumers deserve a transparent process to transact real estate, the biggest asset in one’s financial life.

Best,

Hi Dmitry, reporter here. Thanks for reading. I agree it would be nice to know the fees charged for every home transaction, but I hope you understand as a reporter I am largely limited to what I can learn from public records and what companies chose to disclose. I do not see in the story that I say Opendoor represents consumers in a sale; I would correct that if that were the case. As for what you’re calling the failure rate, that is an interesting data point I didn’t ask directly about. I will keep that in mind as I continue reporting.