A Lakewood company is accusing the Better Business Bureau of tricking customers into believing it is a government agency while issuing biased, unreliable ratings.

A Lakewood company is accusing the Better Business Bureau of tricking customers into believing it is a government agency while issuing biased, unreliable ratings.

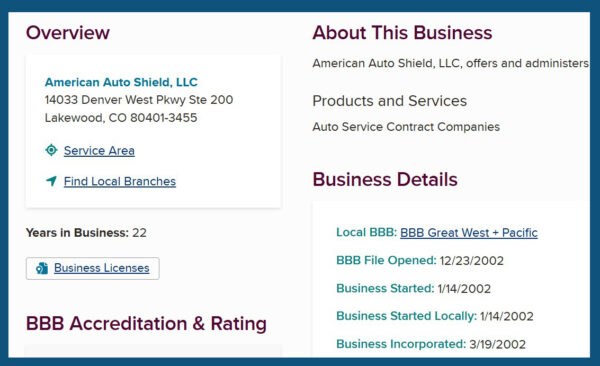

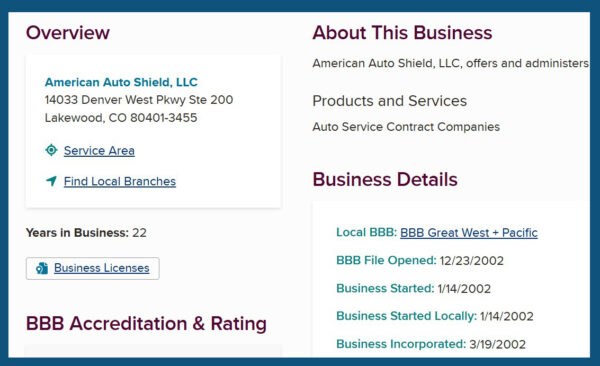

American Auto Shield, which processes extended warranty claims, has a B+ rating but previously had a Not Rated rating. It is suing the BBB Great West & Pacific in Denver District Court. It wants a jury to fine the BBB and bar it from giving AAS an NR rating.

“The ‘NR’ is defamatory as the consuming public generally regards an NR rating from the BBB as negative, meaning the publication harms both AAS’s reputation with its current and potential financial opportunities,” according to the local company’s lawsuit, filed on Nov. 25.

When asked about the lawsuit, Dale Dixon, the BBB’s chief innovation officer, declined to weigh in on the defamation and deception allegations but said that AAS’s complaint was filed only after it “demanded” the BBB not tell the public about a $10 million settlement that AAS and its affiliate, CarShield, agreed to pay the Federal Trade Commission this summer.

The FTC had accused the connected companies — CarShield sells extended warranties and AAS handles claims — of using celebrities and telemarketers to overpromise what is covered by their warranties. Under their settlement, neither company admitted wrongdoing.

Jeffrey Kass, an attorney for American Auto Shield with the Dickinson Wright firm in Denver, said the BBB, not his client, is the one misleading consumers across the country.

“When you hear the word ‘bureau,’ you think that it is part of the government,” Kass told BusinessDen by phone. “And with that comes some more legitimacy. People might think, ‘Whoa, they’re not rated by the government’ or ‘They have a bad rating by the government.’”

Kass claims that Tyler Andrew, CEO of the local BBB chapter, acknowledged in a conversation with AAS “that they know a lot of people think they are with the government.” Kass did not have details about when or where that occurred. Dixon with the BBB declined to comment.

The BBB endured a pay-to-play scandal in the 2010s, when reporters revealed that respectable companies were given poor ratings after they failed to pay the BBB and artificially high ratings when they did pay. A Ritz-Carlton and restaurants by Wolfgang Puck received F grades; Hamas and the white supremacist website Stormfront were handed A grades.

The BBB made changes after the scandal and has won cases in which it was sued over its negative ratings. An online clothing store lost such a case last year in New York. A contractor in Illinois and law firm in Minneapolis have also sued it for defamation and lost.

Rather than defamation, Kass accuses the BBB Great West & Pacific of violating the Colorado Consumer Protection Act in two ways: with its name and its claims of objectivity.

“I’m pretty sure if you got eight jurors together, a large number — all or 80 percent or 60 percent — would say this is the first time they heard (the BBB) wasn’t the government,” he said.

Kass may have an opportunity to do exactly that. If so, he’ll ask jurors to award his client punitive damages “to punish…and deter the BBB” from misleading customers, he said. He first will need to calculate the economic harm to his client, which could prove tricky.

“We have no doubt there are people who have canceled” their warranties with American Auto Shield as a result of the BBB, he said. “Sometimes it’s harder to know who decided not to use your services, but that’s why we have consumer surveys and can poll people.

“We believe we will find actual customers who were affected by the BBB. I mean, the BBB has come up in phone conversations with customers, so we know it’s not hypothetical.”

A Lakewood company is accusing the Better Business Bureau of tricking customers into believing it is a government agency while issuing biased, unreliable ratings.

A Lakewood company is accusing the Better Business Bureau of tricking customers into believing it is a government agency while issuing biased, unreliable ratings.

American Auto Shield, which processes extended warranty claims, has a B+ rating but previously had a Not Rated rating. It is suing the BBB Great West & Pacific in Denver District Court. It wants a jury to fine the BBB and bar it from giving AAS an NR rating.

“The ‘NR’ is defamatory as the consuming public generally regards an NR rating from the BBB as negative, meaning the publication harms both AAS’s reputation with its current and potential financial opportunities,” according to the local company’s lawsuit, filed on Nov. 25.

When asked about the lawsuit, Dale Dixon, the BBB’s chief innovation officer, declined to weigh in on the defamation and deception allegations but said that AAS’s complaint was filed only after it “demanded” the BBB not tell the public about a $10 million settlement that AAS and its affiliate, CarShield, agreed to pay the Federal Trade Commission this summer.

The FTC had accused the connected companies — CarShield sells extended warranties and AAS handles claims — of using celebrities and telemarketers to overpromise what is covered by their warranties. Under their settlement, neither company admitted wrongdoing.

Jeffrey Kass, an attorney for American Auto Shield with the Dickinson Wright firm in Denver, said the BBB, not his client, is the one misleading consumers across the country.

“When you hear the word ‘bureau,’ you think that it is part of the government,” Kass told BusinessDen by phone. “And with that comes some more legitimacy. People might think, ‘Whoa, they’re not rated by the government’ or ‘They have a bad rating by the government.’”

Kass claims that Tyler Andrew, CEO of the local BBB chapter, acknowledged in a conversation with AAS “that they know a lot of people think they are with the government.” Kass did not have details about when or where that occurred. Dixon with the BBB declined to comment.

The BBB endured a pay-to-play scandal in the 2010s, when reporters revealed that respectable companies were given poor ratings after they failed to pay the BBB and artificially high ratings when they did pay. A Ritz-Carlton and restaurants by Wolfgang Puck received F grades; Hamas and the white supremacist website Stormfront were handed A grades.

The BBB made changes after the scandal and has won cases in which it was sued over its negative ratings. An online clothing store lost such a case last year in New York. A contractor in Illinois and law firm in Minneapolis have also sued it for defamation and lost.

Rather than defamation, Kass accuses the BBB Great West & Pacific of violating the Colorado Consumer Protection Act in two ways: with its name and its claims of objectivity.

“I’m pretty sure if you got eight jurors together, a large number — all or 80 percent or 60 percent — would say this is the first time they heard (the BBB) wasn’t the government,” he said.

Kass may have an opportunity to do exactly that. If so, he’ll ask jurors to award his client punitive damages “to punish…and deter the BBB” from misleading customers, he said. He first will need to calculate the economic harm to his client, which could prove tricky.

“We have no doubt there are people who have canceled” their warranties with American Auto Shield as a result of the BBB, he said. “Sometimes it’s harder to know who decided not to use your services, but that’s why we have consumer surveys and can poll people.

“We believe we will find actual customers who were affected by the BBB. I mean, the BBB has come up in phone conversations with customers, so we know it’s not hypothetical.”