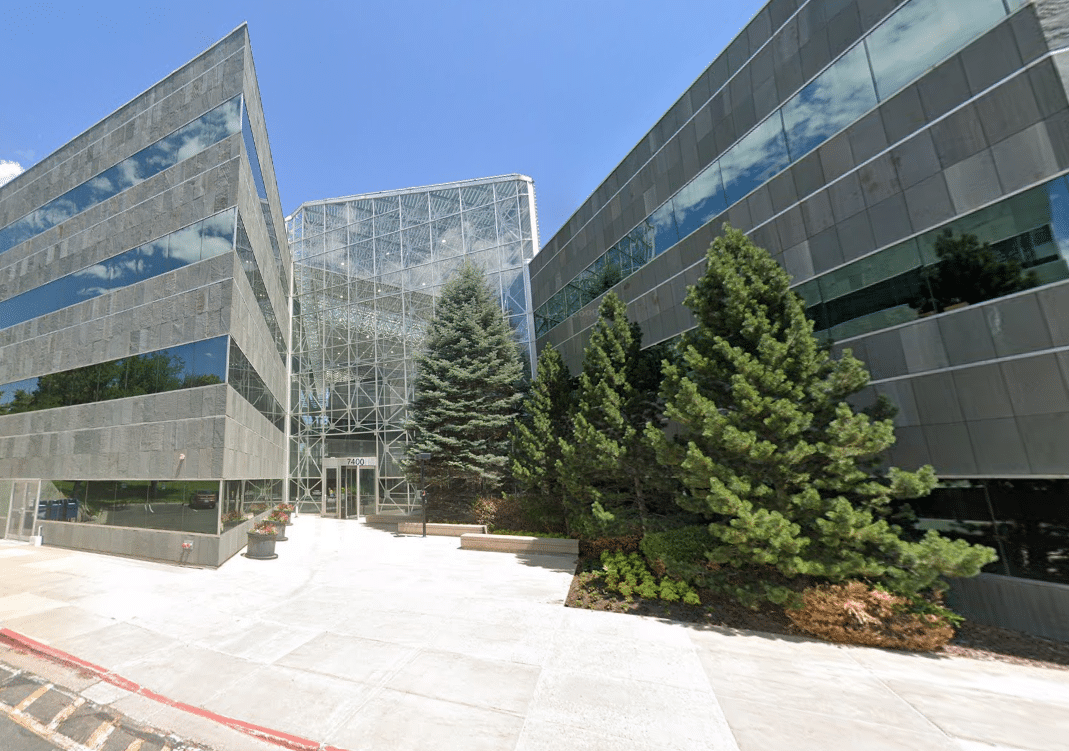

The Solarium office building at 7400 E. Orchard Road in Greenwood Village has a new owner. (Google Street View)

A trust that purchased a distressed Denver Tech Center office building’s loan this summer has taken ownership of the property.

LBC3 Trust, which bought the Solarium building’s loan in August, acquired the Solarium building in Greenwood Village through a foreclosure auction held on Oct. 2, Arapahoe County records show.

The trust submitted a credit bid of $11.2 million for the 170,000-square-foot building at 7400 E. Orchard Road, records show.

That bid was about half the four-story building’s loan amount of $22.7 million, according to the records.

LBC3 Trust lists an office address in Minnesota that corresponds to that of a firm called Stillwater Asset Management. Stillwater Chief Financial Officer Nick Olson, who signed paperwork on behalf of the trust, declined to comment.

Solarium was previously owned by Austin-based CapRidge Partners, which paid $23.4 million for the property in November 2014, records show. CapRidge took out a $20.39 million loan on the property in December 2020 and defaulted when it failed to pay off the loan upon maturity in December 2023.

Solarium is the second major Denver-area office building to transfer ownership this year via a loan sale. The other building is 410 17th St. in downtown Denver. California-based Cress Capital bought that tower’s loan in February and took ownership via a deed-in-lieu of foreclosure at the end of April.

The Cascades office building in Centennial also recently went back to its lender through foreclosure auction.

Read more: Troubled towers: Breaking down Denver’s distressed office properties

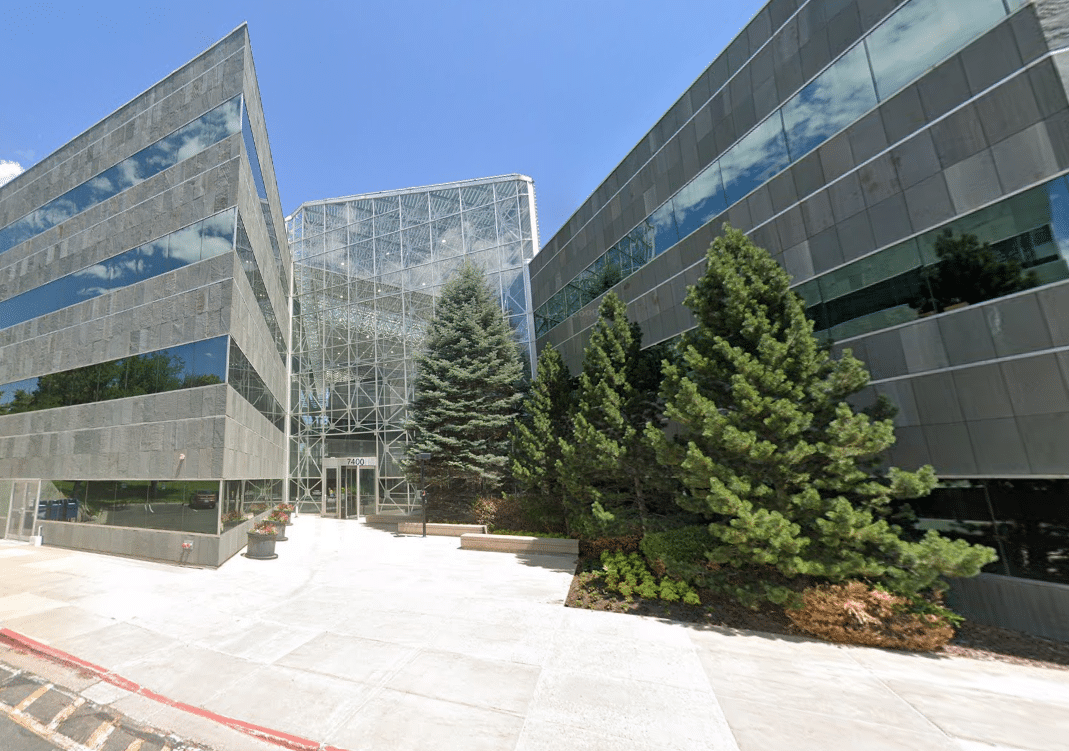

The Solarium office building at 7400 E. Orchard Road in Greenwood Village has a new owner. (Google Street View)

A trust that purchased a distressed Denver Tech Center office building’s loan this summer has taken ownership of the property.

LBC3 Trust, which bought the Solarium building’s loan in August, acquired the Solarium building in Greenwood Village through a foreclosure auction held on Oct. 2, Arapahoe County records show.

The trust submitted a credit bid of $11.2 million for the 170,000-square-foot building at 7400 E. Orchard Road, records show.

That bid was about half the four-story building’s loan amount of $22.7 million, according to the records.

LBC3 Trust lists an office address in Minnesota that corresponds to that of a firm called Stillwater Asset Management. Stillwater Chief Financial Officer Nick Olson, who signed paperwork on behalf of the trust, declined to comment.

Solarium was previously owned by Austin-based CapRidge Partners, which paid $23.4 million for the property in November 2014, records show. CapRidge took out a $20.39 million loan on the property in December 2020 and defaulted when it failed to pay off the loan upon maturity in December 2023.

Solarium is the second major Denver-area office building to transfer ownership this year via a loan sale. The other building is 410 17th St. in downtown Denver. California-based Cress Capital bought that tower’s loan in February and took ownership via a deed-in-lieu of foreclosure at the end of April.

The Cascades office building in Centennial also recently went back to its lender through foreclosure auction.

Read more: Troubled towers: Breaking down Denver’s distressed office properties