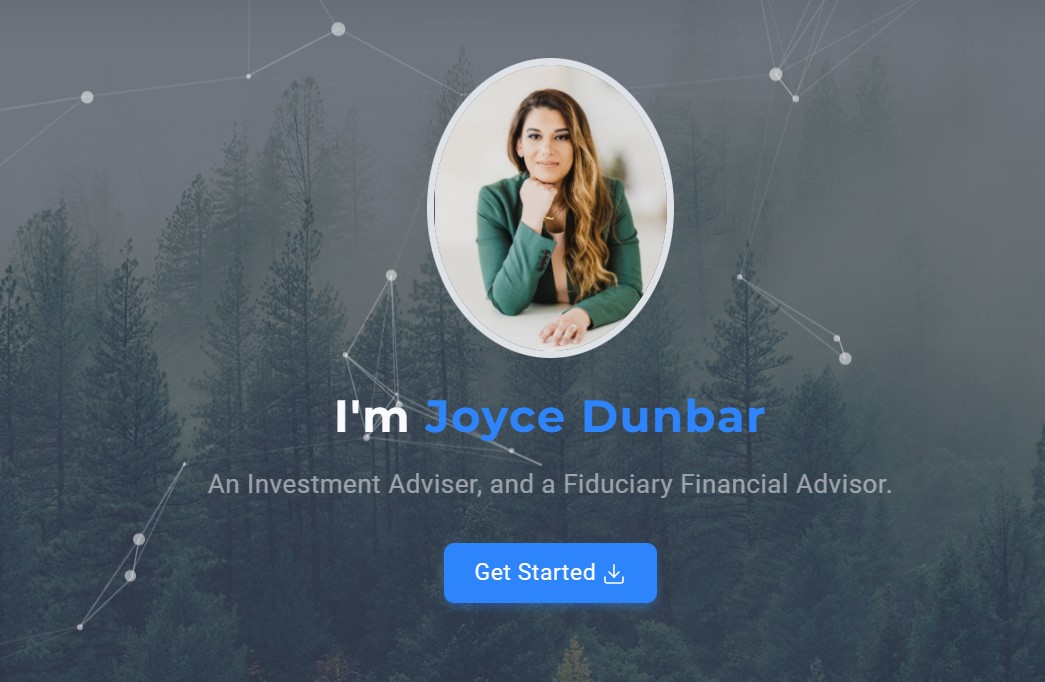

A screenshot from the website of Joyce Dunbar Management before the website was taken down Friday. (JoyceDunbarManagement.com)

As state investigators worked to determine whether Fluxia Capital was a scam, they spotted its address — 1560 Broadway, Suite 800 — and knew they wouldn’t have to go far.

Because their own address is 1560 Broadway, Suite 900.

A quick jaunt downstairs revealed the notable absence of either an office for Fluxia Capital or a Suite 800, according to an affidavit filed April 8 by investigator Jason Gross.

Coincidentally, Fluxia Capital is not the only allegedly fraudulent investment firm with a phony address at 1560 Broadway, the downtown office building that houses the Colorado Division of Securities, which investigates and prosecutes fraudulent investment firms here.

Joyce Dunbar Management, whose “website lists outlandish returns on several Bitcoin investment plans,” according to an April 8 affidavit from Division of Securities investigator Kristofer Ostrom, also claims to have an office in that building. “Staff have verified that no business by the name of Dunbar Management is in the building,” Ostrom said.

The division is demanding that someone from Fluxia and Dunbar appear before a judge April 29 and prove they are not scams. The division said all evidence suggests they are.

For example, Dunbar’s website used photos of a woman purporting to be Joyce Dunbar. In reality, they were photos of Samah Abukhodeir, a lawyer from Miami. In a sworn affidavit, Abukhodeir wrote that she has never met, talked to or heard of a Joyce Dunbar.

Dunbar Management’s website also cited phony broker IDs and state business IDs to appear legitimate, according to Ostrom. The owners took down that website on Friday.

The website, which BusinessDen viewed before its deletion, claimed that a $1,000 investment would garner 10% returns each week, a $50,000 buy-in would earn 15%, and a $100,000 investment would result in 20% returns. It did not explain how.

For its part, Fluxia initially appeared to be a legitimate investment firm, investigators say. It reached out to the Division of Securities in early 2023, seeking a license to sell securities here and Fluxia’s purported compliance officer spoke with the state agency. But his phone number has since been disconnected and he is ignoring emails, investigators say.

“As a legally operating business in Colorado, we are committed to upholding principles of honesty, transparency and responsibility to contribute to the economic development and social progress of the state,” said Fluxia’s website, which is owned by someone in China.

That website falsely claimed that Fluxia has been certified by the Division of Securities and the U.S. Securities and Exchange Commission, according to investigators. It sells a “robust super trading system,” but the Division of Securities doubts its existence.

“Fraudsters using websites to impersonate legitimate investment advisers need to be stopped from victimizing Coloradans,” said Tung Chan, the state securities commissioner.

BusinessDen’s multiple requests for comment from Dunbar and Fluxia were not answered.

When a BusinessDen reporter asked the chatbot on Dunbar’s website whether it is a scam, the chatbot responded, “Joyce Dunbar Management isn’t a scam.” When the reporter asked if Dunbar’s investment plans are too good to be true, the bot changed the subject.

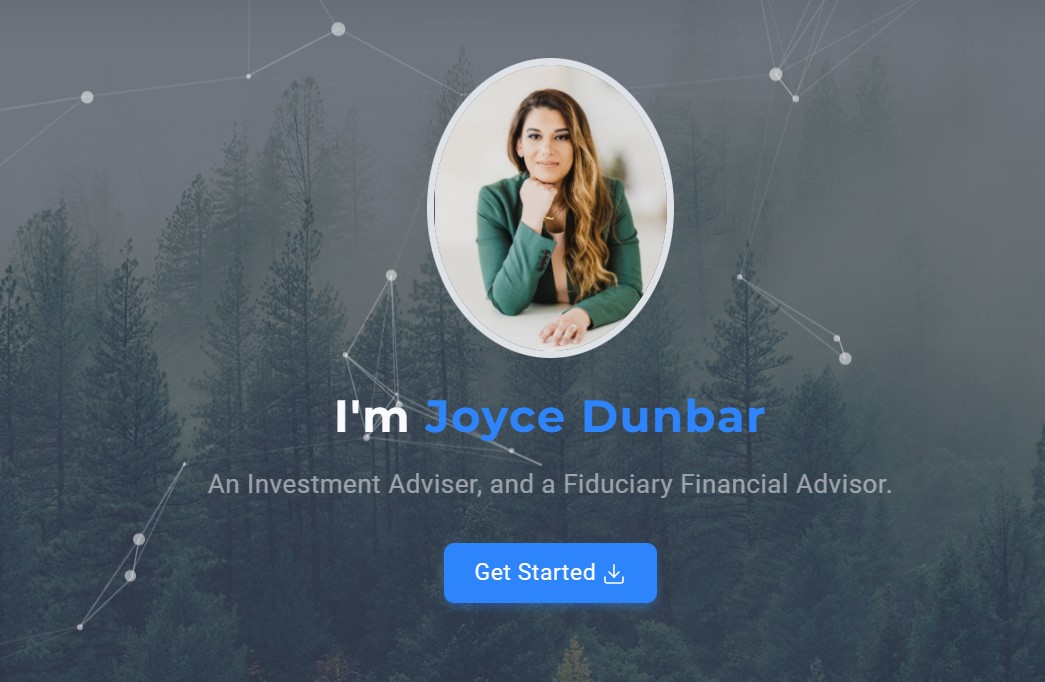

A screenshot from the website of Joyce Dunbar Management before the website was taken down Friday. (JoyceDunbarManagement.com)

As state investigators worked to determine whether Fluxia Capital was a scam, they spotted its address — 1560 Broadway, Suite 800 — and knew they wouldn’t have to go far.

Because their own address is 1560 Broadway, Suite 900.

A quick jaunt downstairs revealed the notable absence of either an office for Fluxia Capital or a Suite 800, according to an affidavit filed April 8 by investigator Jason Gross.

Coincidentally, Fluxia Capital is not the only allegedly fraudulent investment firm with a phony address at 1560 Broadway, the downtown office building that houses the Colorado Division of Securities, which investigates and prosecutes fraudulent investment firms here.

Joyce Dunbar Management, whose “website lists outlandish returns on several Bitcoin investment plans,” according to an April 8 affidavit from Division of Securities investigator Kristofer Ostrom, also claims to have an office in that building. “Staff have verified that no business by the name of Dunbar Management is in the building,” Ostrom said.

The division is demanding that someone from Fluxia and Dunbar appear before a judge April 29 and prove they are not scams. The division said all evidence suggests they are.

For example, Dunbar’s website used photos of a woman purporting to be Joyce Dunbar. In reality, they were photos of Samah Abukhodeir, a lawyer from Miami. In a sworn affidavit, Abukhodeir wrote that she has never met, talked to or heard of a Joyce Dunbar.

Dunbar Management’s website also cited phony broker IDs and state business IDs to appear legitimate, according to Ostrom. The owners took down that website on Friday.

The website, which BusinessDen viewed before its deletion, claimed that a $1,000 investment would garner 10% returns each week, a $50,000 buy-in would earn 15%, and a $100,000 investment would result in 20% returns. It did not explain how.

For its part, Fluxia initially appeared to be a legitimate investment firm, investigators say. It reached out to the Division of Securities in early 2023, seeking a license to sell securities here and Fluxia’s purported compliance officer spoke with the state agency. But his phone number has since been disconnected and he is ignoring emails, investigators say.

“As a legally operating business in Colorado, we are committed to upholding principles of honesty, transparency and responsibility to contribute to the economic development and social progress of the state,” said Fluxia’s website, which is owned by someone in China.

That website falsely claimed that Fluxia has been certified by the Division of Securities and the U.S. Securities and Exchange Commission, according to investigators. It sells a “robust super trading system,” but the Division of Securities doubts its existence.

“Fraudsters using websites to impersonate legitimate investment advisers need to be stopped from victimizing Coloradans,” said Tung Chan, the state securities commissioner.

BusinessDen’s multiple requests for comment from Dunbar and Fluxia were not answered.

When a BusinessDen reporter asked the chatbot on Dunbar’s website whether it is a scam, the chatbot responded, “Joyce Dunbar Management isn’t a scam.” When the reporter asked if Dunbar’s investment plans are too good to be true, the bot changed the subject.