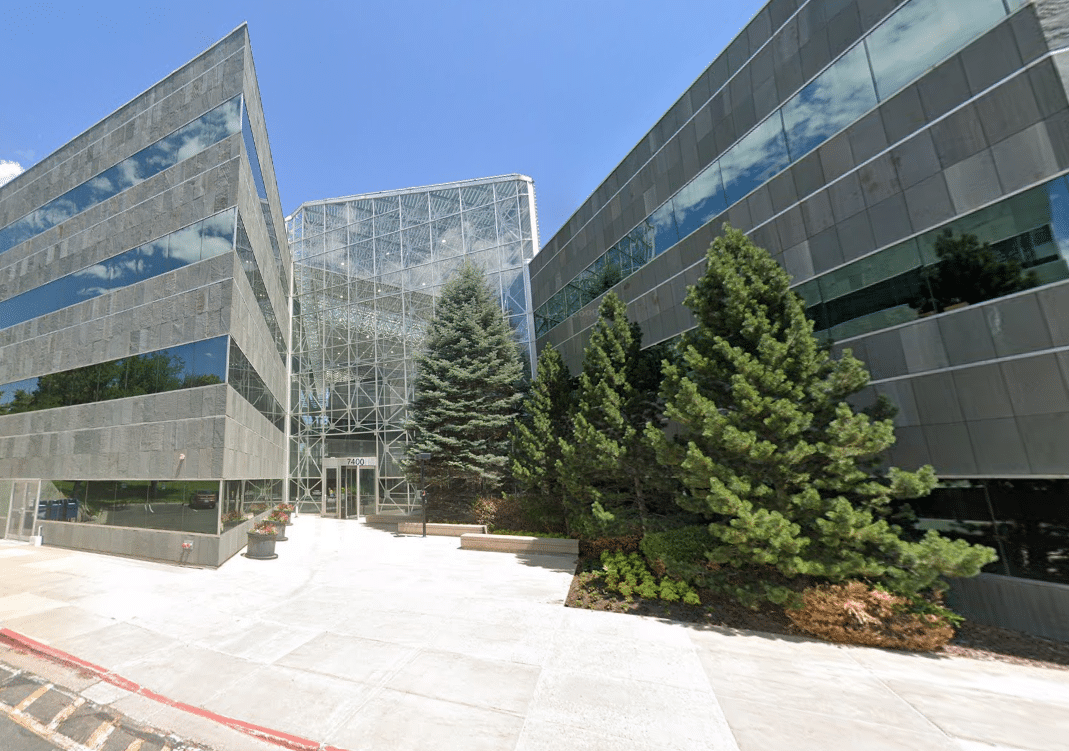

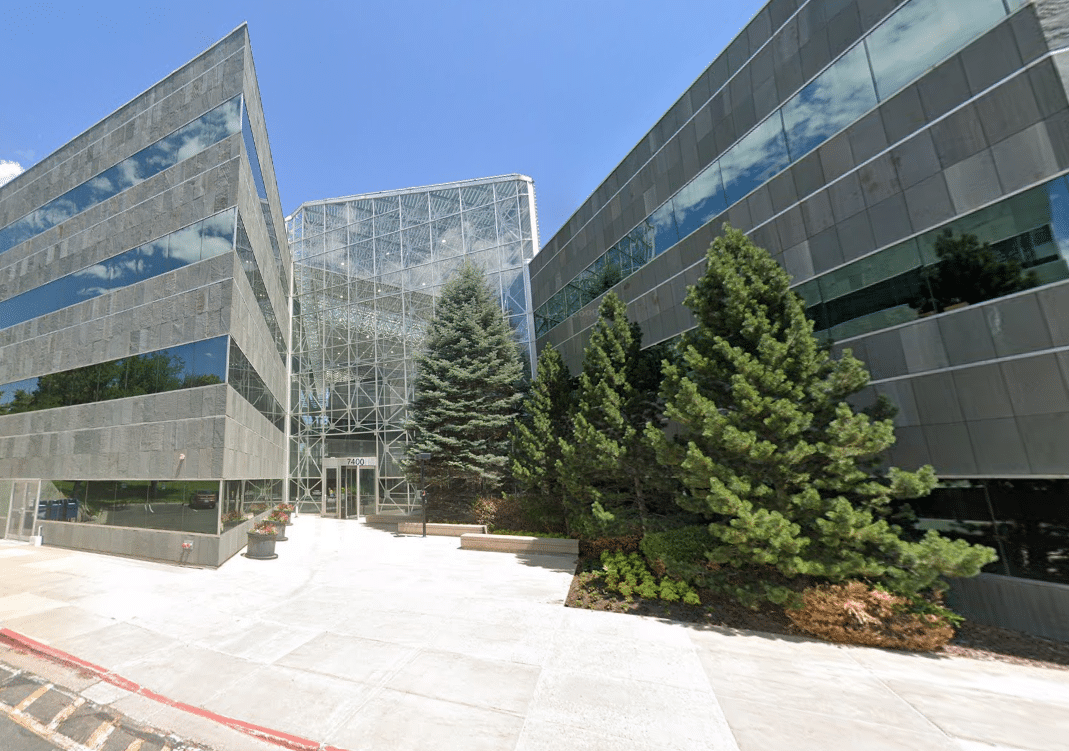

The owner of the Solarium office building at 7400 E. Orchard Road in Greenwood Village has defaulted on its loan, according to the lender. (Google Street View)

A lender has filed to foreclose on the Solarium building in the Denver Tech Center, after saying it intended to do so in January.

New York-based Ready Capital submitted the paperwork regarding the Solarium building at 7400 E. Orchard Road in Greenwood Village on Tuesday.

The four-story, approximately 170,000-square-foot building is owned by CPVF II Solarium LLC, an affiliate of Austin-based CapRidge Partners. The firm paid $23.4 million for the property in November 2014, according to public records.

In December 2020, according to a January lawsuit, CapRidge took out a $20.39 million loan against the property from KeyBank. The loan was later assigned to New York-based Ready Capital.

CapRidge failed to pay off the loan by the maturity date, which was Dec. 10 of last year. At Ready Capital’s request, Trigild IVL was appointed as receiver of the building on Jan. 12.

CapRidge still owes $20.07 million on the loan, according to the foreclosure paperwork filed this week.

CapRidge didn’t respond to a request for comment on Thursday. Locally, the firm also owns multiple office buildings in Westminster and the Creekside Business Park in Longmont, according to its website.

Solarium is one of three buildings in Greenwood Village — one of six in the southern part of the metropolitan area — to enter receivership in the last year. The Triad Office Complex sold at auction to its lender in December, while the owner of 7100 E. Belleview Ave. gave back the keys in September.

Read more (newly updated): Troubled towers: Breaking down Denver’s distressed office properties

The owner of the Solarium office building at 7400 E. Orchard Road in Greenwood Village has defaulted on its loan, according to the lender. (Google Street View)

A lender has filed to foreclose on the Solarium building in the Denver Tech Center, after saying it intended to do so in January.

New York-based Ready Capital submitted the paperwork regarding the Solarium building at 7400 E. Orchard Road in Greenwood Village on Tuesday.

The four-story, approximately 170,000-square-foot building is owned by CPVF II Solarium LLC, an affiliate of Austin-based CapRidge Partners. The firm paid $23.4 million for the property in November 2014, according to public records.

In December 2020, according to a January lawsuit, CapRidge took out a $20.39 million loan against the property from KeyBank. The loan was later assigned to New York-based Ready Capital.

CapRidge failed to pay off the loan by the maturity date, which was Dec. 10 of last year. At Ready Capital’s request, Trigild IVL was appointed as receiver of the building on Jan. 12.

CapRidge still owes $20.07 million on the loan, according to the foreclosure paperwork filed this week.

CapRidge didn’t respond to a request for comment on Thursday. Locally, the firm also owns multiple office buildings in Westminster and the Creekside Business Park in Longmont, according to its website.

Solarium is one of three buildings in Greenwood Village — one of six in the southern part of the metropolitan area — to enter receivership in the last year. The Triad Office Complex sold at auction to its lender in December, while the owner of 7100 E. Belleview Ave. gave back the keys in September.

Read more (newly updated): Troubled towers: Breaking down Denver’s distressed office properties