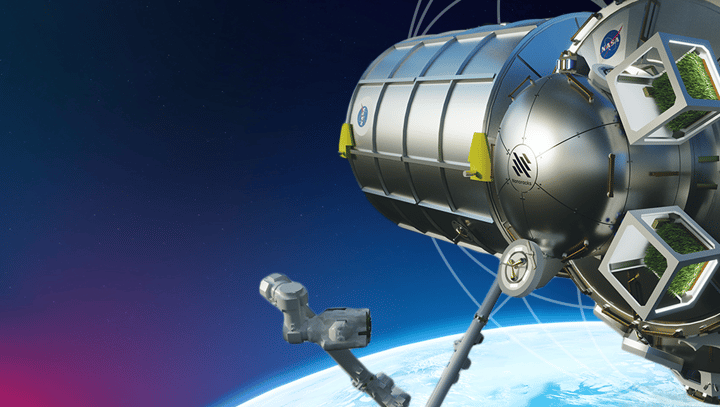

Voyager Space Holdings is working on its Starlab commercial space station, intended to incorporate state-of-the-art research labs for research and host up to four astronauts in orbit. (Courtesy Voyager Space Holdings)

Despite an uncertain economy in the first half of 2023, with high inflation and interest rates, Colorado’s startups were still pulling in cash.

BusinessDen compared startup funding raised from January to June over the past six years, and the numbers indicate investors aren’t slowing down.

According to a tally of Form Ds, startups have raised $2.3 billion in the first six months of this year, which is $1.7 million more than the same period last year.

C.J. Whelan, executive director of Rockies Venture Club (RVC), said that while the angel investing group’s number of investments is down this year compared to last, the startup and entrepreneur market is robust.

“One of the upsides, from an investor standpoint, about economic uncertainty and more generally pull-back in investing across all sectors … is it brings the better deals to the top,” Whelan said.

Whelan said RVC angel investors and others are currently heavily interested in life science investments, things like medical devices and software. He said other companies that are raising significant capital right now include biologics and pharmaceuticals.

Otherwise, he said, investors are trending to companies that are more established with less risk.

“The whole notion of these better deal opportunities, better companies … maybe they have a product on the market, they’ve got some revenue, they’ve got a team,” Whelan said.

In the first half of 2020, when the pandemic began, funding fell to $820 million. It then skyrocketed in 2021, with $3 billion raised by the end of June. Whelan described 2021 as an “anomaly.”

“In the height of the pandemic, things were frozen up and that left a fair amount of money,” Whelan said. “When things came roaring back … it became frothy in so many ways: pent up demand, money on the sidelines coming back to play, and trends pre-pandemic, it was just a unique opportunity.”

Those two years aside, the amount of money raised by Colorado businesses in the first half of the year has gradually increased since 2018. Overall, funding increased $1.75 billion from 2018 to 2023.

“The state of startups and entrepreneurs I think, fundamentally, is really really strong and you can couple that with some fundamental changes that COVID brought,” Whelan said. “I don’t see it doing anything other than continuing. There will be ups and downs … but I don’t feel any great cliff or danger happening.”

In the first half of 2002, when the pandemic began, funding fell to $820 million. It then skyrocketed in 2021, with $3 billion raised by the end of June. Those two years aside, the amount of money raised by Colorado businesses in the first half of the year has gradually increased since 2018. Overall, funding increased $1.75 billion from 2018 to 2023.

BusinessDen defines a startup as a business that’s less than 10 years old and excludes publicly traded companies, real estate ventures and funds.

Here are the top five raises so far this year:

Forefront Physicians (Broomfield): $114.11 million

The dermatology health care group raised $114 million in March. The dermatology practice provides medical and cosmetic services, with over 250 physicians and across 27 states, according to its website. The company is partially owned by its own physicians and the private investment group Partners Group.

BillGo Inc. (Fort Collins): $94.34 million

The software company that provides users with one platform to pay all their bills in real time raised $94 million in May. Founded in 2015 by Dan Holt, BillGo has roughly 32 million users, according to its website.

BioDerm (Denver): $85.36 million

BioDerm, which designs products like catheters and adhesive removers, brought in $85 million in February. In 2020, it began making its “faceplate strip” for health care workers, designed to protect their skin from excessive PPE use. That same year, BioDerm had its first equity investment, joining MountainGate Capital’s portfolio.

Voyager Space Holdings (Denver): $80.2 million

The aerospace company raised more than any other startup in January with $80.2 million. Its current focus is agriculture in space and “space sustainability,” to protect space “from the same mistakes humans have made on earth,” according to its website.

Iontra (Denver): $46.89 million

The battery-charging company made the top five so far this year with just under $47 million raised in May. Iontra makes more efficient chargers for all types of electronics, from smartphones to electric vehicles. Unlike other technology, Iontra’s charger preserves lithium batteries so they last longer and hold a more efficient charge, according to the company.