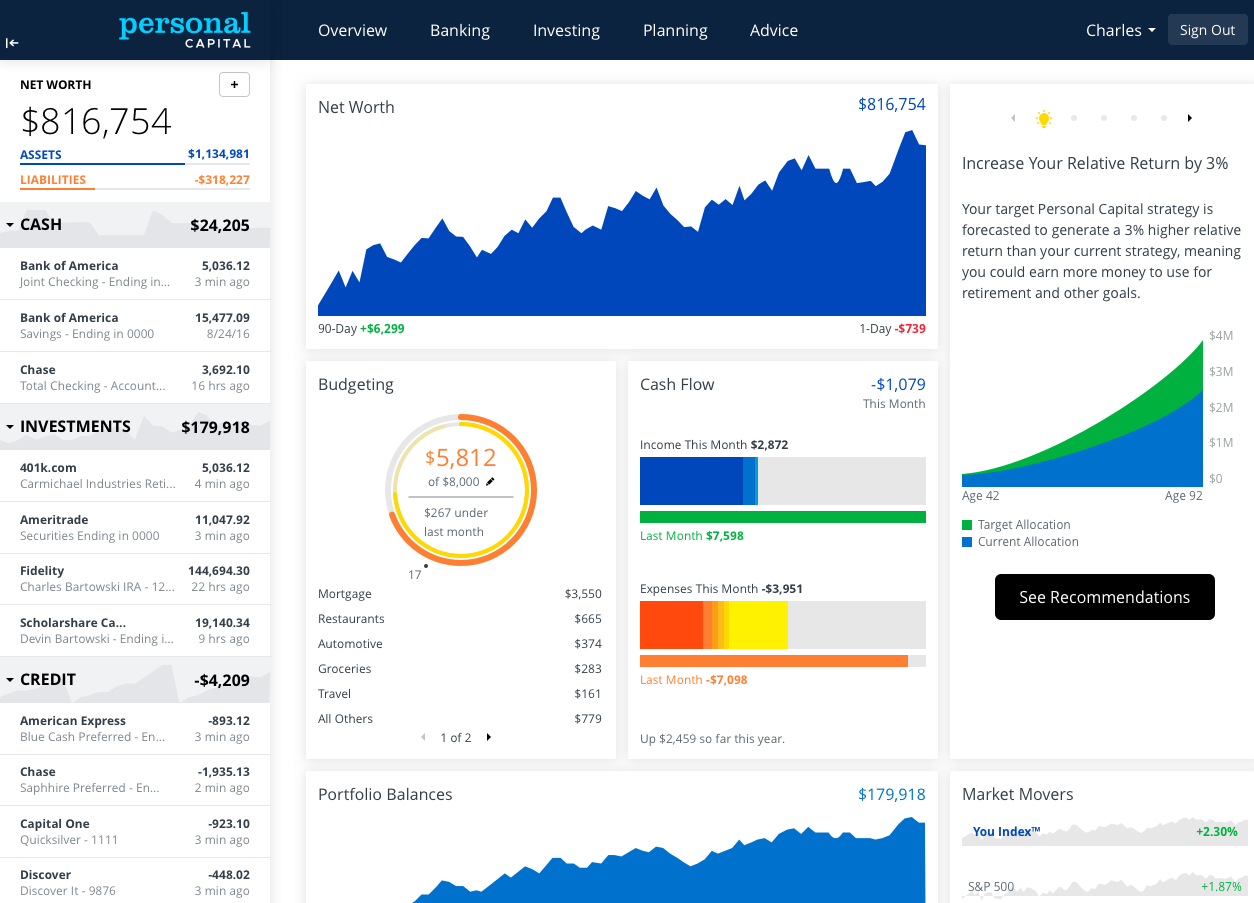

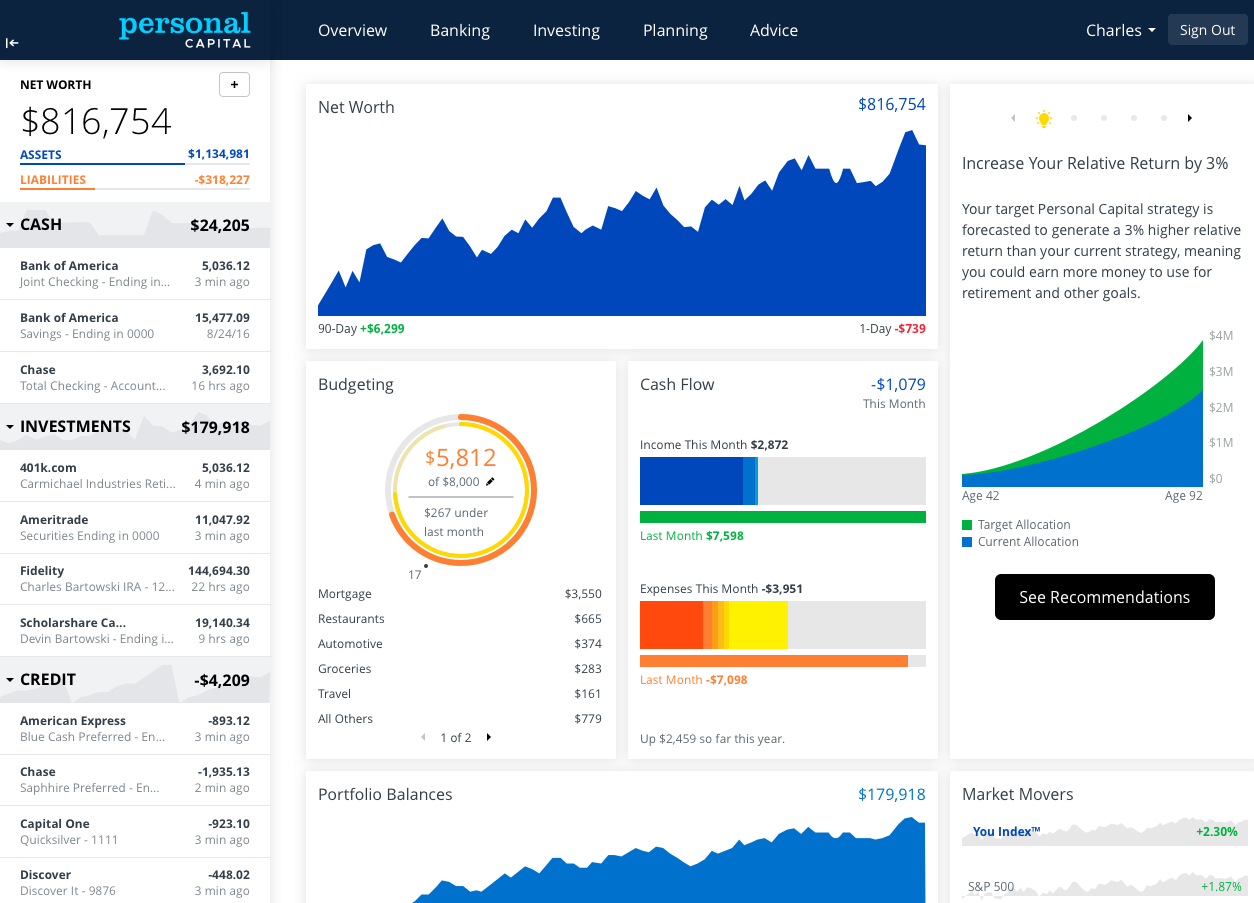

Personal Capital’s online dashboard allows users to link various accounts to see their net worth. (Courtesy Personal Capital)

Personal Capital, an 11-year-old wealth management firm known for its digital tools, has agreed to be purchased by Empower Retirement.

Greenwood Village-based Empower, which said it is the nation’s second-largest retirement services provider, is set to pay up to $1 billion for Personal Capital, which is based in the Bay Area and has an office in Denver.

Empower will pay $825 million upon closing for Personal Capital, the companies said Monday. The company then will spend up to an additional $175 million for “planned growth” if Personal Capital achieves certain goals, which an Empower spokeswoman declined to disclose.

The deal, which is subject to regulatory approvals, is expected to close by year-end.

Empower, formed in 2014, administers $656 billion in assets on behalf of 9.7 million American workers through approximately 40,000 workplace savings plans. Last year, the company reached a 21-year deal with the Denver Broncos to have the team name its stadium Empower Field at Mile High.

Personal Capital was founded in 2009. It is known for its free online tools that allow users to link all their financial accounts to see their net worth. The company has approximately 2.5 million users, tracking over $771 billion of household assets, according to the news release announcing Monday’s deal.

Personal Capital makes money by selling advisory services to its users, targeting those with at least $100,000 in assets. It manages approximately $12.5 billion for 24,000 clients, the companies said.

“The acquisition of Personal Capital and the integration of their tools and capabilities into the Empower offering is designed to create a best-of-breed platform — powered by digital and human advice — to help individuals achieve their financial goals,” Empower CEO Edmund F. Murphy III said in a statement.

In Denver, Personal Capital operates out of 31,248 square feet in Granite Tower at 1099 18th St. The company said it has 406 employees, 159 of whom are in Denver.

When the deal closes, Personal Capital CEO Jay Shah will serve as president of Personal Capital, reporting to Murphy III.

Sullivan & Cromwell LLP served as legal counsel, and Morgan Stanley & Co. LLC and Rockefeller Capital Management served as financial advisors to Empower. Willkie Farr & Gallagher LLP served as legal counsel and Moelis & Co. LLC served as financial advisor to Personal Capital.

Personal Capital’s online dashboard allows users to link various accounts to see their net worth. (Courtesy Personal Capital)

Personal Capital, an 11-year-old wealth management firm known for its digital tools, has agreed to be purchased by Empower Retirement.

Greenwood Village-based Empower, which said it is the nation’s second-largest retirement services provider, is set to pay up to $1 billion for Personal Capital, which is based in the Bay Area and has an office in Denver.

Empower will pay $825 million upon closing for Personal Capital, the companies said Monday. The company then will spend up to an additional $175 million for “planned growth” if Personal Capital achieves certain goals, which an Empower spokeswoman declined to disclose.

The deal, which is subject to regulatory approvals, is expected to close by year-end.

Empower, formed in 2014, administers $656 billion in assets on behalf of 9.7 million American workers through approximately 40,000 workplace savings plans. Last year, the company reached a 21-year deal with the Denver Broncos to have the team name its stadium Empower Field at Mile High.

Personal Capital was founded in 2009. It is known for its free online tools that allow users to link all their financial accounts to see their net worth. The company has approximately 2.5 million users, tracking over $771 billion of household assets, according to the news release announcing Monday’s deal.

Personal Capital makes money by selling advisory services to its users, targeting those with at least $100,000 in assets. It manages approximately $12.5 billion for 24,000 clients, the companies said.

“The acquisition of Personal Capital and the integration of their tools and capabilities into the Empower offering is designed to create a best-of-breed platform — powered by digital and human advice — to help individuals achieve their financial goals,” Empower CEO Edmund F. Murphy III said in a statement.

In Denver, Personal Capital operates out of 31,248 square feet in Granite Tower at 1099 18th St. The company said it has 406 employees, 159 of whom are in Denver.

When the deal closes, Personal Capital CEO Jay Shah will serve as president of Personal Capital, reporting to Murphy III.

Sullivan & Cromwell LLP served as legal counsel, and Morgan Stanley & Co. LLC and Rockefeller Capital Management served as financial advisors to Empower. Willkie Farr & Gallagher LLP served as legal counsel and Moelis & Co. LLC served as financial advisor to Personal Capital.

Leave a Reply