Embattled real estate investor Gary Dragul is taking issue with the cost of the receiver winding down his company.

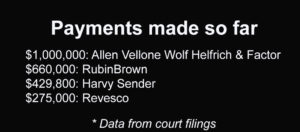

Dragul, who was indicted in 2018 and 2019 on multiple counts of securities fraud, claims in recent court filings that receiver Harvey Sender milked the estate for almost $2.5 million, with another $400,000 bill pending.

And Sender missed an opportunity to sell assets for enough to make investors whole, Dragul claims.

“In the first three months of receivership, before the receiver or his counsel had incurred much in fees billed against the estate, the receiver received and rejected offers to purchase much of or all of the assets in Receivership, each of which would have netted the estate – and the investors – over $5,000,000 and in most cases would have resulted in a full recovery,” the filings say.

About $520,000 remains in the estate for distribution to creditors, Dragul said in a June 5 filing. That amounts to about 17 percent of the fees the receiver and his contractors have asked for.

Lawyers who work as receivers must get court approval for their legal fees. Dragul is contesting the fees and wants the court to void the latest invoice for $400,000.

“I allowed a receiver to come take over my business because we thought it was the best thing to do for the investors and employees. And that it would allow us to attract a capital buyer or partner,” Dragul said when reached by phone.

Dragul also claims Sender is billing extra hours for suing him and his family when he already has all his assets and a net worth of zero.

“The receiver has incurred and will continue to incur significant fees and costs with no hope of recovering anything more from Mr. Dragul or creditors,” the filings say. “The only parties who benefit from this are the receiver and his counsel.”

Sender, when reached by phone, said that the fees are indeed substantial.

“We are aware of the costs, and I wish it would have been simpler or easier,” he said.

Sender said that litigation against Dragul and his family, and other former partners, might turn up more cash. And he’s paying lawyers working on that component of the litigation on a contingency basis to try to limit future legal bills.

One reason for the millions in fees, Sender said, was “all the misrepresentations from Dragul.”

“Most of the factual representations by Dragul through his lawyer in the pleading are either misrepresentations or false,” he said.

Dragul initially was indicted on nine counts of securities fraud in April 2018. He was indicated on an additional five counts in March 2019.

The bulk of the Happy Canyon Shopping Center, which Dragul had owned, sold for $24.2 million last year. (BizDen file photo)

Sender was appointed as a receiver overseeing Dragul’s assets in August 2018, and has sold off or abandoned all the real estate. He previously said in court documents that Dragul used stolen funds to pay personal gambling debts of almost $9 million and transfer millions of dollars to his wife and children, and more broadly to “fund his extravagant lifestyle.”

Sender, who last fall characterized Dragul’s business as a Ponzi scheme, said he tried to negotiate with every potential buyer who kicked the tires.

“We negotiated with the buyers but they either turned out to not be real or were shills for Dragul … Most of them when they did their due diligence walked away,” he said.

Sender said some of the offers asked him to settle Dragul’s civil and criminal cases, requests that the Colorado Division of Securities rejected.

Sender also said that the properties he took over and wanted to sell to create funds for the estate had no cash and deferred maintenance. Several properties were turned back over to the lenders.

Dragul claims that Sender allowed properties to fall behind on mortgage payments and fall into disrepair.

“Every house that he was in charge of was rented and was collecting income,” Dragul said.

“Every property that had defaults was because Harvey didn’t make mortgage payments,” Dragul said, adding, “He took over 24 houses and he wound up abandoning 18 of them, of which in a year and a half time period four were unhabitable.”

“The facts speak for themselves,” Dragul said.

Embattled real estate investor Gary Dragul is taking issue with the cost of the receiver winding down his company.

Dragul, who was indicted in 2018 and 2019 on multiple counts of securities fraud, claims in recent court filings that receiver Harvey Sender milked the estate for almost $2.5 million, with another $400,000 bill pending.

And Sender missed an opportunity to sell assets for enough to make investors whole, Dragul claims.

“In the first three months of receivership, before the receiver or his counsel had incurred much in fees billed against the estate, the receiver received and rejected offers to purchase much of or all of the assets in Receivership, each of which would have netted the estate – and the investors – over $5,000,000 and in most cases would have resulted in a full recovery,” the filings say.

About $520,000 remains in the estate for distribution to creditors, Dragul said in a June 5 filing. That amounts to about 17 percent of the fees the receiver and his contractors have asked for.

Lawyers who work as receivers must get court approval for their legal fees. Dragul is contesting the fees and wants the court to void the latest invoice for $400,000.

“I allowed a receiver to come take over my business because we thought it was the best thing to do for the investors and employees. And that it would allow us to attract a capital buyer or partner,” Dragul said when reached by phone.

Dragul also claims Sender is billing extra hours for suing him and his family when he already has all his assets and a net worth of zero.

“The receiver has incurred and will continue to incur significant fees and costs with no hope of recovering anything more from Mr. Dragul or creditors,” the filings say. “The only parties who benefit from this are the receiver and his counsel.”

Sender, when reached by phone, said that the fees are indeed substantial.

“We are aware of the costs, and I wish it would have been simpler or easier,” he said.

Sender said that litigation against Dragul and his family, and other former partners, might turn up more cash. And he’s paying lawyers working on that component of the litigation on a contingency basis to try to limit future legal bills.

One reason for the millions in fees, Sender said, was “all the misrepresentations from Dragul.”

“Most of the factual representations by Dragul through his lawyer in the pleading are either misrepresentations or false,” he said.

Dragul initially was indicted on nine counts of securities fraud in April 2018. He was indicated on an additional five counts in March 2019.

The bulk of the Happy Canyon Shopping Center, which Dragul had owned, sold for $24.2 million last year. (BizDen file photo)

Sender was appointed as a receiver overseeing Dragul’s assets in August 2018, and has sold off or abandoned all the real estate. He previously said in court documents that Dragul used stolen funds to pay personal gambling debts of almost $9 million and transfer millions of dollars to his wife and children, and more broadly to “fund his extravagant lifestyle.”

Sender, who last fall characterized Dragul’s business as a Ponzi scheme, said he tried to negotiate with every potential buyer who kicked the tires.

“We negotiated with the buyers but they either turned out to not be real or were shills for Dragul … Most of them when they did their due diligence walked away,” he said.

Sender said some of the offers asked him to settle Dragul’s civil and criminal cases, requests that the Colorado Division of Securities rejected.

Sender also said that the properties he took over and wanted to sell to create funds for the estate had no cash and deferred maintenance. Several properties were turned back over to the lenders.

Dragul claims that Sender allowed properties to fall behind on mortgage payments and fall into disrepair.

“Every house that he was in charge of was rented and was collecting income,” Dragul said.

“Every property that had defaults was because Harvey didn’t make mortgage payments,” Dragul said, adding, “He took over 24 houses and he wound up abandoning 18 of them, of which in a year and a half time period four were unhabitable.”

“The facts speak for themselves,” Dragul said.

Leave a Reply