Dan Burrell’s 8,400-square-foot home at 768 Hunter Creek Road in Aspen. (Mountain Home Photo/Concierge Auctions)

A wealthy Aspenite said that he shouldn’t have to repay $56 million in loans to a Denver bank that has caused him a “public disgrace” and is trying to foreclose on his estates.

Dan Burrell, 45, was sued by First Western Bank in November. It claims to have made four loans to the entrepreneur between 2019 and 2022 and is asking an Aspen judge to let it foreclose on a half-dozen properties that are collateral for those loans.

Burrell then countersued First Western this month, accusing the bank of violating federal lending laws, interfering with an auction of his $38.5 million house and invading his privacy.

The businessman’s attorneys allege it was “improper” for First Western to give him business loans when it knew that most of the money would be spent on Burrell’s personal expenses, like building a house in Basalt, making divorce payments and buying a yacht.

“Additionally, First Western did not make a reasonable and good faith determination at or before consummation that Burrell had a reasonable ability to repay,” his countersuit states.

The bank also didn’t allow him to refinance, didn’t consistently provide him with paperwork for the loans, and wrongly accepted his personal homes as collateral, Burrell alleged.

“As a result, Burrell, Burrell’s wife, and Burrell’s minor children are at risk of losing their primary residence and have incurred emotional distress,” according to the countersuit.

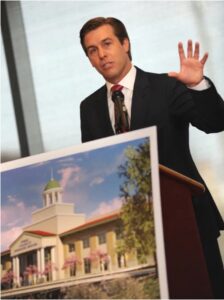

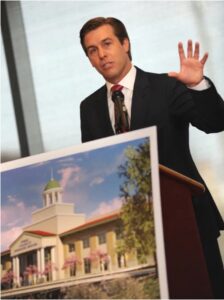

Dan Burrell is a founder of the Burrell College of Osteopathic Medicine. (Courtesy of New Mexico State University)

In recent months, Burrell has tried to auction off his 8,400-square-foot house on Red Mountain in Aspen and a 4,200-acre ranch in nearby Carbondale for $86.5 million. Sotheby’s no longer lists the ranch for sale and has extended its bid deadline for the house to Feb. 15.

Without giving details, the countersuit claims that First Western has “wrongly interfered” with “pending contracts to sell” the Aspen house, the Carbondale ranch, a property in Nantucket and land in Vero Beach, Fla. Those and others are collateral for First Western’s loans.

“This has put Burrell’s ability to sell the collateral at full market value at risk,” it claimed.

First Western’s attorneys — Trevor Bartel and Frances Scioscia Staadt with the Denver office of Lewis Roca Rothgerber Christie — declined to comment on the countersuit.

Burrell wants Judge Christopher Seldin to rescind the loans and order First Western to stop interfering with his attempted auctioning of the house in Aspen. Burrell is also seeking damages for what he claims was a public outing of his financial situation by First Western.

During an earnings call in October, First Western CEO Scott Wylie referred to “a client we’ve had since 2018” who is “facing a liquidity crunch and becoming delinquent on their payments,” requiring the bank to declare the loans in default and seek the collateral.

“We think we’re going to have a full recovery. The real estate collateral that we have is in some very desirable markets. It’s in Aspen, it’s in Nantucket, it’s in (Florida),” he said.

Though Wylie didn’t name the borrower, Burrell said that analysts listening to the call were able to figure it out. One even called him to ask about his personal finances. This has caused Burrell and his investment company “reputational harm and public disgrace,” he claimed.

“A reasonable person of ordinary sensibilities would find the disclosure of those private facts about themselves highly offensive,” Burrell’s attorneys wrote in the Jan. 8 countersuit.

In addition to the Pitkin County case, First Western is also suing Burrell in Eagle County in an attempt to foreclose on his properties at 969 Willits Lane and 1043 Willits Lane in Basalt, where the Burrells have been living since December. He was also sued in Aspen on Dec. 14 by U.S. Bank, which said that Burrell owes $3.7 million. That case is also ongoing.

Burrell is represented by attorneys Sarah Auchterlonie and Courtney Bartkus in the Denver office of Brownstein Hyatt Farber Schreck.

Dan Burrell’s 8,400-square-foot home at 768 Hunter Creek Road in Aspen. (Mountain Home Photo/Concierge Auctions)

A wealthy Aspenite said that he shouldn’t have to repay $56 million in loans to a Denver bank that has caused him a “public disgrace” and is trying to foreclose on his estates.

Dan Burrell, 45, was sued by First Western Bank in November. It claims to have made four loans to the entrepreneur between 2019 and 2022 and is asking an Aspen judge to let it foreclose on a half-dozen properties that are collateral for those loans.

Burrell then countersued First Western this month, accusing the bank of violating federal lending laws, interfering with an auction of his $38.5 million house and invading his privacy.

The businessman’s attorneys allege it was “improper” for First Western to give him business loans when it knew that most of the money would be spent on Burrell’s personal expenses, like building a house in Basalt, making divorce payments and buying a yacht.

“Additionally, First Western did not make a reasonable and good faith determination at or before consummation that Burrell had a reasonable ability to repay,” his countersuit states.

The bank also didn’t allow him to refinance, didn’t consistently provide him with paperwork for the loans, and wrongly accepted his personal homes as collateral, Burrell alleged.

“As a result, Burrell, Burrell’s wife, and Burrell’s minor children are at risk of losing their primary residence and have incurred emotional distress,” according to the countersuit.

Dan Burrell is a founder of the Burrell College of Osteopathic Medicine. (Courtesy of New Mexico State University)

In recent months, Burrell has tried to auction off his 8,400-square-foot house on Red Mountain in Aspen and a 4,200-acre ranch in nearby Carbondale for $86.5 million. Sotheby’s no longer lists the ranch for sale and has extended its bid deadline for the house to Feb. 15.

Without giving details, the countersuit claims that First Western has “wrongly interfered” with “pending contracts to sell” the Aspen house, the Carbondale ranch, a property in Nantucket and land in Vero Beach, Fla. Those and others are collateral for First Western’s loans.

“This has put Burrell’s ability to sell the collateral at full market value at risk,” it claimed.

First Western’s attorneys — Trevor Bartel and Frances Scioscia Staadt with the Denver office of Lewis Roca Rothgerber Christie — declined to comment on the countersuit.

Burrell wants Judge Christopher Seldin to rescind the loans and order First Western to stop interfering with his attempted auctioning of the house in Aspen. Burrell is also seeking damages for what he claims was a public outing of his financial situation by First Western.

During an earnings call in October, First Western CEO Scott Wylie referred to “a client we’ve had since 2018” who is “facing a liquidity crunch and becoming delinquent on their payments,” requiring the bank to declare the loans in default and seek the collateral.

“We think we’re going to have a full recovery. The real estate collateral that we have is in some very desirable markets. It’s in Aspen, it’s in Nantucket, it’s in (Florida),” he said.

Though Wylie didn’t name the borrower, Burrell said that analysts listening to the call were able to figure it out. One even called him to ask about his personal finances. This has caused Burrell and his investment company “reputational harm and public disgrace,” he claimed.

“A reasonable person of ordinary sensibilities would find the disclosure of those private facts about themselves highly offensive,” Burrell’s attorneys wrote in the Jan. 8 countersuit.

In addition to the Pitkin County case, First Western is also suing Burrell in Eagle County in an attempt to foreclose on his properties at 969 Willits Lane and 1043 Willits Lane in Basalt, where the Burrells have been living since December. He was also sued in Aspen on Dec. 14 by U.S. Bank, which said that Burrell owes $3.7 million. That case is also ongoing.

Burrell is represented by attorneys Sarah Auchterlonie and Courtney Bartkus in the Denver office of Brownstein Hyatt Farber Schreck.