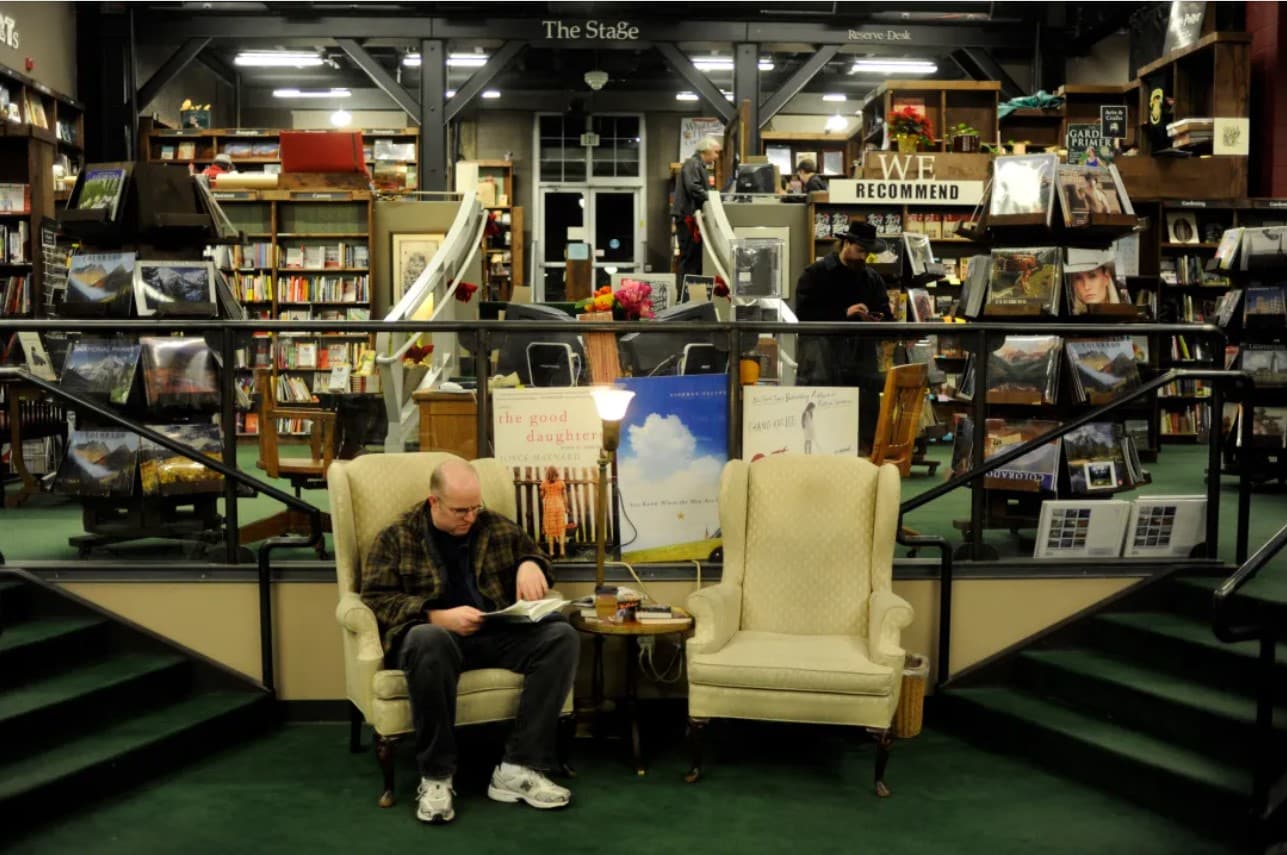

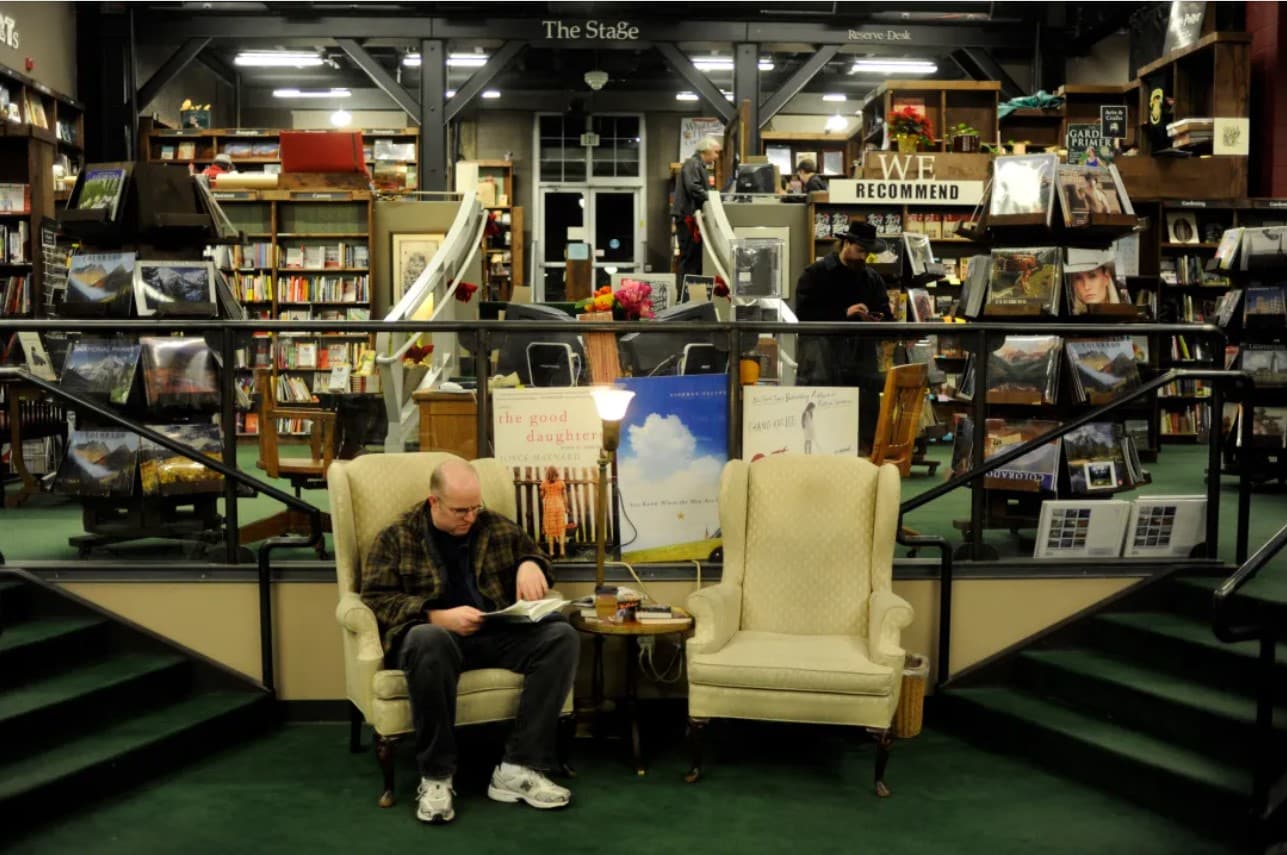

Jonathan Dow reads at the Tattered Cover on Thursday, Dec. 8, 2011. (AAron Ontiveroz/The Denver Post)

A former CEO of Tattered Cover who wants to buy the bankrupt company is suggesting its current CEO is the wrong person to lead it and undeserving of a $120,000 salary.

Kwame Spearman, who currently owns a minority stake in the company, led Tattered Cover between early 2021 and early 2023, when he stepped down following an aborted mayoral bid to focus on running for Denver school board, ultimately unsuccessfully.

His successor is Brad Dempsey, a bankruptcy attorney who took over soon before the company filed for Chapter 11 in October and has led it through the bankruptcy process. Tattered Cover’s board of directors wants him to stay on through 2024 in exchange for $120,000.

Bankrupt companies must receive court approval for certain expenditures, including some executive salaries, and creditors of those companies can weigh in on the proposed spending. Of the 420 people and companies that Tattered Cover owes money to — and who therefore have a right to object to the $120,000 salary request — only one has so far: Spearman.

On Jan. 2, he wrote to U.S. Bankruptcy Judge Michael Romero that Tattered Cover “has not articulated how paying its CEO $120,000” is best for the company and “has only proven Mr. Dempsey is a credible attorney, which is a vastly different skill set than what the business needs in 2024.” He doubts Dempsey’s business, finance and human resources acumen.

“In addition, (Tattered Cover) nor Mr. Dempsey have provided creditors with any business plan for 2024,” he said. “Can the court confirm Mr. Dempsey’s compensation without an intimate understanding of how the business will be run in 2024?…It feels premature.”

Tattered Cover’s “largest store underperformed against 2022 figures during the (2023) holiday season,” Spearman wrote in asking Romero to reject the $120,000 salary. “Its second largest location also underperformed. In total sales for all stores combined, business remained flat, despite the opportunity for significant community goodwill following the bankruptcy.”

The two-page objection was signed “William Spearman,” the ex-CEO’s legal name.

Reached by email the next day, Dempsey said Spearman “is wrong about a key metric.”

“Tattered Cover did beat 2022 sales for this November and December, thanks to the incredible hard work by our team and support from the communities we serve,” he said.

Dempsey touted his own work acquiring a $1.3 million loan from local philanthropists. A clause in that loan requires Dempsey to remain CEO or else the money stops flowing. Dempsey sees this as evidence that he is the right man to keep Tattered Cover financially upright.

“I won’t speculate as to his agenda for filing the only objection,” he said of Spearman.

It’s not the only ongoing dispute between the former CEO of Tattered Cover and its current leadership. Spearman claims that he is owed $198,000 from Tattered Cover — money that he supposedly loaned the company in 2022 — but Tattered Cover disputes that.

Spearman owns 1.4 million shares of Tattered Cover’s 2.7 million shares of common stock, according to the company’s bankruptcy paperwork. Tattered Cover also has 1.6 million shares of Class A stock, which are split among two dozen people and companies.

“Mr. Spearman is a minority shareholder in the company,” Dempsey notes. “He does not sit on the board of directors and is not involved in any aspect of Tattered Cover’s management or operations — and hasn’t been since early 2023,” when he left to run for office.

Spearman may be trying to change that, however. Late last week, his lawyers asked the U.S. Bankruptcy Court to let him subpoena Tattered Cover’s balance sheets and profit-and-loss statements in order “to evaluate the terms of a potential offer” to purchase it.

“Mr. Spearman is a shareholder and creditor of (Tattered Cover). He and associated investors are interested in acquiring the business or its assets,” the attorneys wrote.

Meanwhile, at a brief hearing Thursday, Tattered Cover attorney Gabrielle Palmer told Judge Romero that the company plans to reach out to Spearman about his objection to Dempsey’s $120,000 salary “and we hope that we will be able to resolve that consensually.”

Tattered Cover intends to file its plan for reorganization by the middle of this month. If approved by Romero, that plan will allow the company to emerge from bankruptcy.

“I drove by the McGregor Square spot and saw a toy store in place of the old Tattered Cover space and that was a bit unusual to see,” Romero said at Thursday’s hearing, referring to one of three locations that Dempsey and Tattered Cover closed in the fall.

“But I’m very happy to see that you had a good, successful end-of-year season,” the judge said. “We’ll keep our fingers crossed that this thing continues to go smoothly.”

Jonathan Dow reads at the Tattered Cover on Thursday, Dec. 8, 2011. (AAron Ontiveroz/The Denver Post)

A former CEO of Tattered Cover who wants to buy the bankrupt company is suggesting its current CEO is the wrong person to lead it and undeserving of a $120,000 salary.

Kwame Spearman, who currently owns a minority stake in the company, led Tattered Cover between early 2021 and early 2023, when he stepped down following an aborted mayoral bid to focus on running for Denver school board, ultimately unsuccessfully.

His successor is Brad Dempsey, a bankruptcy attorney who took over soon before the company filed for Chapter 11 in October and has led it through the bankruptcy process. Tattered Cover’s board of directors wants him to stay on through 2024 in exchange for $120,000.

Bankrupt companies must receive court approval for certain expenditures, including some executive salaries, and creditors of those companies can weigh in on the proposed spending. Of the 420 people and companies that Tattered Cover owes money to — and who therefore have a right to object to the $120,000 salary request — only one has so far: Spearman.

On Jan. 2, he wrote to U.S. Bankruptcy Judge Michael Romero that Tattered Cover “has not articulated how paying its CEO $120,000” is best for the company and “has only proven Mr. Dempsey is a credible attorney, which is a vastly different skill set than what the business needs in 2024.” He doubts Dempsey’s business, finance and human resources acumen.

“In addition, (Tattered Cover) nor Mr. Dempsey have provided creditors with any business plan for 2024,” he said. “Can the court confirm Mr. Dempsey’s compensation without an intimate understanding of how the business will be run in 2024?…It feels premature.”

Tattered Cover’s “largest store underperformed against 2022 figures during the (2023) holiday season,” Spearman wrote in asking Romero to reject the $120,000 salary. “Its second largest location also underperformed. In total sales for all stores combined, business remained flat, despite the opportunity for significant community goodwill following the bankruptcy.”

The two-page objection was signed “William Spearman,” the ex-CEO’s legal name.

Reached by email the next day, Dempsey said Spearman “is wrong about a key metric.”

“Tattered Cover did beat 2022 sales for this November and December, thanks to the incredible hard work by our team and support from the communities we serve,” he said.

Dempsey touted his own work acquiring a $1.3 million loan from local philanthropists. A clause in that loan requires Dempsey to remain CEO or else the money stops flowing. Dempsey sees this as evidence that he is the right man to keep Tattered Cover financially upright.

“I won’t speculate as to his agenda for filing the only objection,” he said of Spearman.

It’s not the only ongoing dispute between the former CEO of Tattered Cover and its current leadership. Spearman claims that he is owed $198,000 from Tattered Cover — money that he supposedly loaned the company in 2022 — but Tattered Cover disputes that.

Spearman owns 1.4 million shares of Tattered Cover’s 2.7 million shares of common stock, according to the company’s bankruptcy paperwork. Tattered Cover also has 1.6 million shares of Class A stock, which are split among two dozen people and companies.

“Mr. Spearman is a minority shareholder in the company,” Dempsey notes. “He does not sit on the board of directors and is not involved in any aspect of Tattered Cover’s management or operations — and hasn’t been since early 2023,” when he left to run for office.

Spearman may be trying to change that, however. Late last week, his lawyers asked the U.S. Bankruptcy Court to let him subpoena Tattered Cover’s balance sheets and profit-and-loss statements in order “to evaluate the terms of a potential offer” to purchase it.

“Mr. Spearman is a shareholder and creditor of (Tattered Cover). He and associated investors are interested in acquiring the business or its assets,” the attorneys wrote.

Meanwhile, at a brief hearing Thursday, Tattered Cover attorney Gabrielle Palmer told Judge Romero that the company plans to reach out to Spearman about his objection to Dempsey’s $120,000 salary “and we hope that we will be able to resolve that consensually.”

Tattered Cover intends to file its plan for reorganization by the middle of this month. If approved by Romero, that plan will allow the company to emerge from bankruptcy.

“I drove by the McGregor Square spot and saw a toy store in place of the old Tattered Cover space and that was a bit unusual to see,” Romero said at Thursday’s hearing, referring to one of three locations that Dempsey and Tattered Cover closed in the fall.

“But I’m very happy to see that you had a good, successful end-of-year season,” the judge said. “We’ll keep our fingers crossed that this thing continues to go smoothly.”