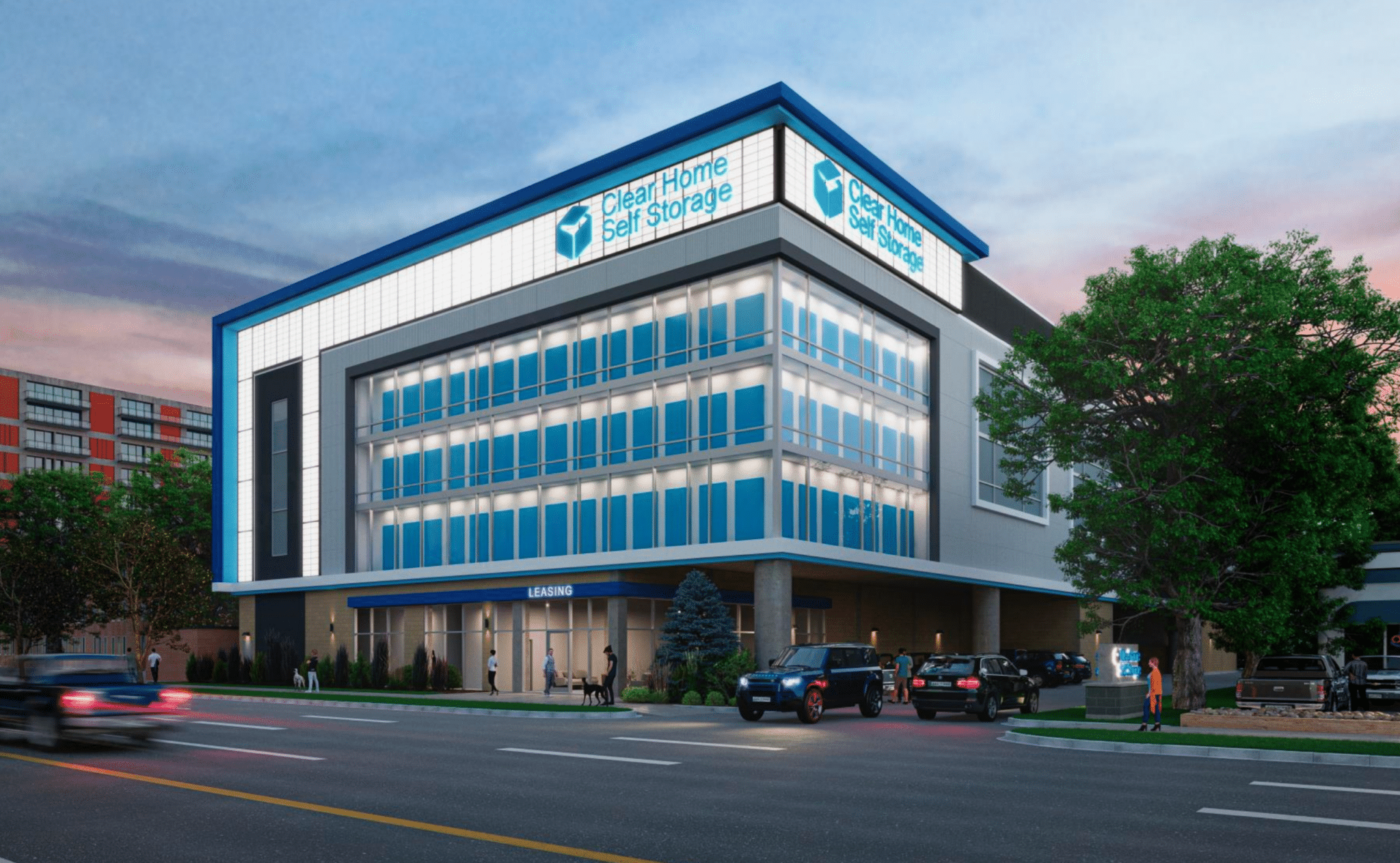

A rendering of the project. (Courtesy VanWest Partners)

Some people use self-storage facilities to store their stuff. For others, it’s to store their money.

VanWest Partners, a Denver firm specializing in purchasing, developing and managing self-storage facilities, is planning to construct a five-story self-storage building at 2425 S. Colorado Blvd. on the edge of University Park.

Private investors will fund the project, a common practice for the business that manages nearly 40 locations across the nation.

“We think self-storage is a great asset class to create cash flow,” said Jacob Vanderslice, principal at VanWest. “We mitigate risk as much as we can by looking at supply ratios, demographic trends, but it’s mostly by just staying true to reasonable and conservative underwriting assumptions.”

The building will have 1,100 climate-controlled storage units. Sizes range from five feet by five feet to 10 feet by 30 feet and monthly rents will range from $50 to $500. An office building at the site constructed in 1978 was previously demolished.

The development is expected to be completed by early 2025.

Waner will serve as the general contractor on the project. Upon completion, ClearHome Self Storage, a wholly owned subsidiary of VanWest, will assume management. The company bought the land, slightly larger than 1 acre, in April for $4.25 million.

Wintrust Financial provided a $13.67 million construction loan for the project. Vanderslice said VanWest plans to keep the property for five to six years.

Normally, he would hold the space for slightly longer, usually around seven years. The reason for this project’s shorter timeline is because it is a new development and not part of a larger investment fund, Vanderslice said.

“Philosophically, we target medium to longer term holds – unless there’s a good reason for it, we don’t like selling quickly,” he said.

VanWest, which started investing in real estate in 2006 and got into the self-storage game roughly a decade later, owns 38 self-storage facilities. This new construction will be the only one in Denver. The business does have two others in northern Colorado, however.

“We regrettably only have three assets in our backyard,” Vanderslice said. “We’re from here and it’s our hometown, but it’s hard to find deals … the rest of our asset base is out of state: Midwest, Southeast, Southwest.

“We’ve been involved in a number of self-storage acquisition and development projects around Denver over the years – however, over the last five years, the majority of our activity has been out of state. We’re excited to have a new project underway in our hometown again.”

The business offers an investment fund that pools together the revenue generated from self-storage acquisitions around the country. The current fund owns 11 self-storage facilities totaling $80 million in capitalization. These spaces are locations which VanWest acquires and manages, while development projects such as the one along Colorado Boulevard are packaged into individual investment opportunities due to their higher risk.

“A lot of the deals that we target are just smaller operators, they lack efficient revenue management, their expense loads are above market, their rents and their ancillary income streams are below market. And we’ll buy these and simply just run them more efficiently. That’s a big component of our value creation,” Vanderslice said.

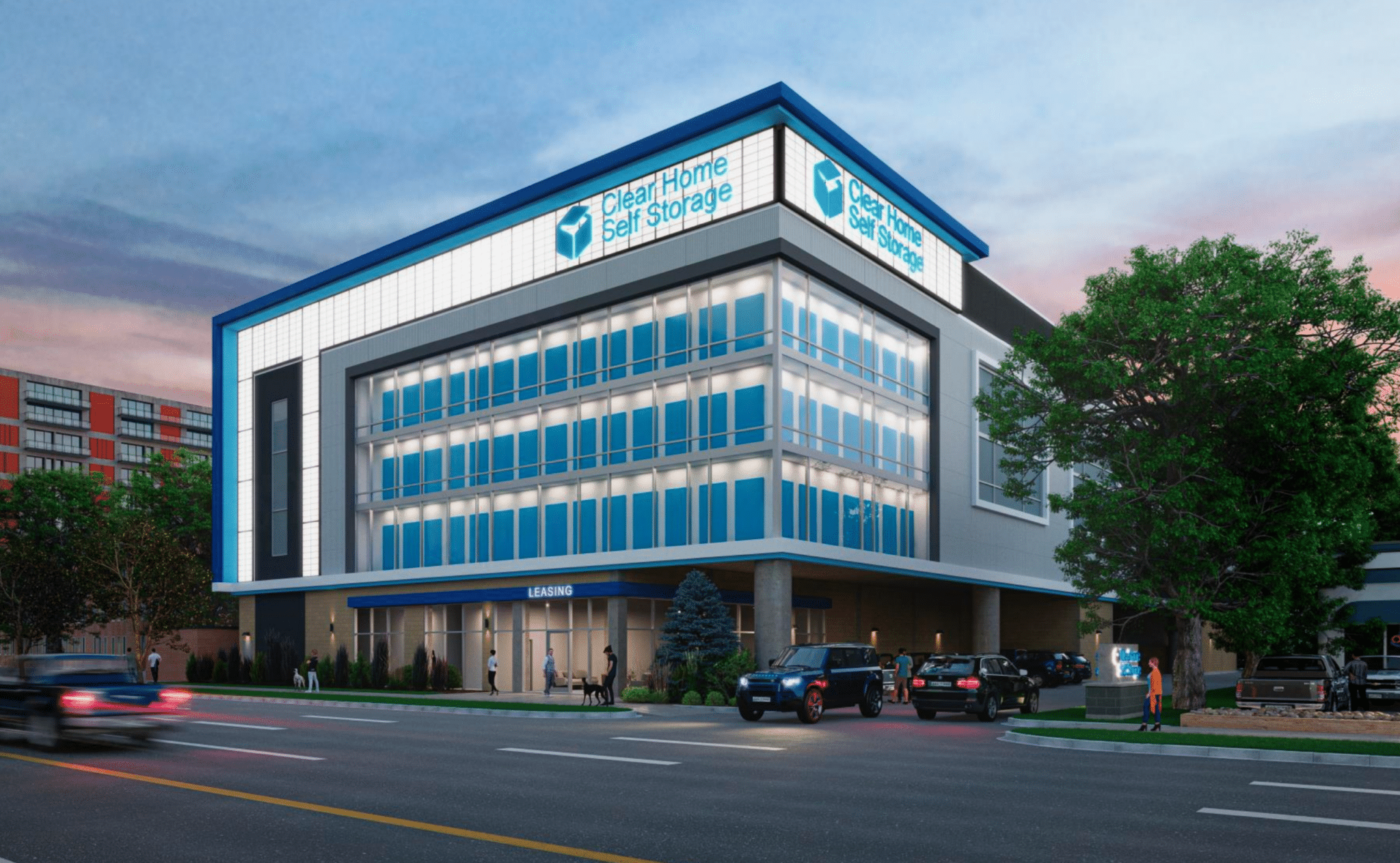

A rendering of the project. (Courtesy VanWest Partners)

Some people use self-storage facilities to store their stuff. For others, it’s to store their money.

VanWest Partners, a Denver firm specializing in purchasing, developing and managing self-storage facilities, is planning to construct a five-story self-storage building at 2425 S. Colorado Blvd. on the edge of University Park.

Private investors will fund the project, a common practice for the business that manages nearly 40 locations across the nation.

“We think self-storage is a great asset class to create cash flow,” said Jacob Vanderslice, principal at VanWest. “We mitigate risk as much as we can by looking at supply ratios, demographic trends, but it’s mostly by just staying true to reasonable and conservative underwriting assumptions.”

The building will have 1,100 climate-controlled storage units. Sizes range from five feet by five feet to 10 feet by 30 feet and monthly rents will range from $50 to $500. An office building at the site constructed in 1978 was previously demolished.

The development is expected to be completed by early 2025.

Waner will serve as the general contractor on the project. Upon completion, ClearHome Self Storage, a wholly owned subsidiary of VanWest, will assume management. The company bought the land, slightly larger than 1 acre, in April for $4.25 million.

Wintrust Financial provided a $13.67 million construction loan for the project. Vanderslice said VanWest plans to keep the property for five to six years.

Normally, he would hold the space for slightly longer, usually around seven years. The reason for this project’s shorter timeline is because it is a new development and not part of a larger investment fund, Vanderslice said.

“Philosophically, we target medium to longer term holds – unless there’s a good reason for it, we don’t like selling quickly,” he said.

VanWest, which started investing in real estate in 2006 and got into the self-storage game roughly a decade later, owns 38 self-storage facilities. This new construction will be the only one in Denver. The business does have two others in northern Colorado, however.

“We regrettably only have three assets in our backyard,” Vanderslice said. “We’re from here and it’s our hometown, but it’s hard to find deals … the rest of our asset base is out of state: Midwest, Southeast, Southwest.

“We’ve been involved in a number of self-storage acquisition and development projects around Denver over the years – however, over the last five years, the majority of our activity has been out of state. We’re excited to have a new project underway in our hometown again.”

The business offers an investment fund that pools together the revenue generated from self-storage acquisitions around the country. The current fund owns 11 self-storage facilities totaling $80 million in capitalization. These spaces are locations which VanWest acquires and manages, while development projects such as the one along Colorado Boulevard are packaged into individual investment opportunities due to their higher risk.

“A lot of the deals that we target are just smaller operators, they lack efficient revenue management, their expense loads are above market, their rents and their ancillary income streams are below market. And we’ll buy these and simply just run them more efficiently. That’s a big component of our value creation,” Vanderslice said.